Search Results for "taxation"

UK Tax Authority Updates Its Guidelines for Crypto Taxation

HMRC updates its guidelines for crypto – taxation, relating to both individuals and businesses. The new guidelines explicitly state that crypto-currencies are not considered as ‘money.’

Shenzhen Taxation Bureau to Launch New Blockchain Tax System with Ping An Group

Ping An Insurance and the Shenzhen Taxation Bureau in China signed an agreement to start using blockchain, artificial intelligence (AI), big data, cloud computing, and other technologies to develop a management platform for taxation for all types of taxpayers in the Greater Bay Area.

South Korean Tax Specialists Advocate for Lowered Crypto Taxation

Members of the Korean Tax Policy Association are calling on the government to consider applying a low-level tax on crypto transactions. The South Korean administration is contemplating taxing cryptocurrencies as part of its tax reform plan for 2021, but specialists feel it requires in-depth conceptualization.

PwC Expert's Take: What Are the 3 Grey Areas to Crypto Taxation in Hong Kong?

The Inland Revenue Department (IRD) of Hong Kong took a step further to provide clarity in taxing digital assets. In the recent press release titled “LCQ20: Regulation of virtual asset investment activities”, James Lau, the Secretary for Financial Services and the Treasury answered the queries raised by the Hon Wu Chi-wai on taxation of virtual assets, tax evasion of virtual asset-related business and latest effort to regulate virtual assets by the Hong Kong Securities and Futures Commission (SFC).

Albania to Begin Levying Crypto Tax Next Year, Report says

Southern European country Albania is reportedly on track to begin taxing digital currency earnings as of 2023. Individual miners could be charged up to 15% of capital gain tax.

High Taxation in Japan is Driving Crypto Businesses Away, Entrepreneur Says

To prevent entrepreneurs from leaving the nation, Japan should minimize corporate taxes on crypto businesses, according to Sota Watanabe, the CEO of Stake Technologies Pte.

Swiss City Lugano Partners with Tether to Adopt Crypto Tax Payments

The City of Lugano in Switzerland has entered into a partnership with Tether Operations Limited to drive its technological advancement while enabling its capabilities to allow its residents to pay their taxes through cryptocurrencies.

South Korea to Introduce 10%-50% Gift Tax on Crypto Airdrops

Users who receive crypto airdrops in South Korea could be taxed at 10%-50%. The virtual asset gains tax will start taking effect in 2025.

South Korea Plans to Suspend Crypto Taxation Until 2023

Crypto investors in South Korea might have a sigh of relief because the government intends to delay imposing crypto taxation until 2023.

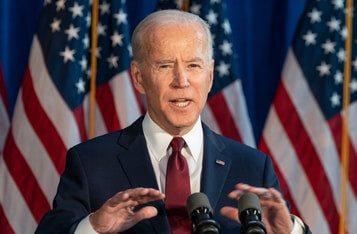

President Biden’s Tax Plans Spark Fear, Triggering a Bitcoin and Ethereum Price Drop

The speculation that U.S. President Joe Biden’s administration will increase capital gains taxes sent shock waves in the crypto space as Bitcoin (BTC) and Ethereum (ETH) dropped amid fears that this initiative could limit investment in digital assets.

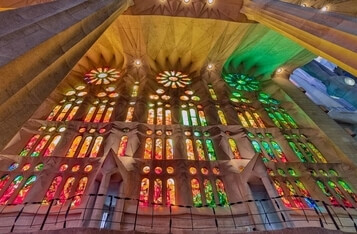

Spain Strengthens Crypto Oversight to Settle Tax Debts

Spanish Ministry of Finance is implementing legislative reforms to increase cryptocurrency monitoring, enabling seizure of digital assets for tax debt resolution, aligning with EU regulations.

Bitcoin Bleeds Across the Board as BTC Drops to a 6-Week Price Low

Market analyst Joseph Young believes that fear is causing the Bitcoin market to drop.