Search Results for "european central bank"

European Central Bank is Consulting the Public on CBDC

The European Central Bank has launched a public consultation to seek public opinion on its proposed digital Euro or central bank digital currency (CBDC).

European Central Bank Assesses Potential Digital Euro CBDC Issuance

The European Central Bank (ECB) evaluated whether a digital euro would be a beneficial addition to its financial system through an October report.

European Central Bank Plans to Take the Lead on Stablecoins

European Central Bank President Christine Lagarde has urged the ECB to take the lead regarding stablecoins, citing increased interests in the space from central banks in Britain, Canada, and China.

European Central Bank President: Coronavirus Has Accelerated Digital Currency Adoption

COVID-19 has led to an acceleration in digital payments adoption and technological innovation, as seen by the spending pattern of European citizens.

Bitcoin Billionaire Winklevoss Slams European Central Bank Money Printing Despite Strong Euro

Bitcoin billionaire and Gemini Exchange Founder Tyler Winklevoss Slams European Central Bank's continued stimulus and low refinancing rates despite a strong Euro.

European Central Bank Encourages Clear Regulatory Structure for Stablecoins to Reap the Benefits While Minimizing Potential Risks

The European Central Bank (ECB) published an in-depth report on global stablecoins, focusing on highlighting the requirement for clear regulatory parameters for stablecoins, and the risks it may pose to financial stability. The ECB suggests that a “robust regulatory framework” must be established to address risks before its benefits could be explored.

Six Central Banks Form Working Group to Assess Central Bank Digital Currencies

Six central banks around the world have come together to create a working group to share experiences on use cases on central bank digital currency (CBDC). With significant expertise in exploring digital currencies, these six central banks are the Bank of Canada, Bank of England, Bank of Japan, European Central bank, Sveriges Riksbank in Sweden, and the Swiss National Bank, and the Bank of International Settlements (BIS).

CBDCs Are Bad News to European Banks, says Bank of America Analysts

Bank of America analysts have made important revelations concerning the launch of CBDCs. They recently disclosed that CBDCs are bad news to European Banks.

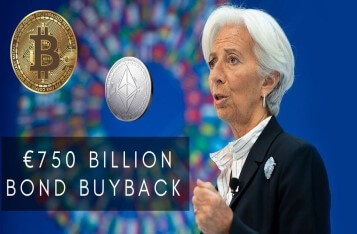

Christine Lagarde Announced EUR 750 Billion Bond Buyback, Bitcoin Surged 10%

With the launch of ECB's €750 Billion bond buyback, Bitcoin, in the last 24 hours witnessed a steep increase in price clocking at 16% growth.

European Central Bank Hikes Interest Rates in Surprise Move, Bitcoin Remains Steady

The European Central Bank (ECB) on Thursday increased its benchmark rate from -0.5% to 0%. Crypto market remains steady, Bitcoin stands firm above $23K level during the Asia trading section.

Bitcoin Price as Likely as Gold to Rally Higher, Investors Await ECB Policy Meeting Outcome

Bitcoin is now more closely correlated to safe haven asset gold than ever, which enables the world’s largest cryptocurrency to be able to combat risk aversion.

German Finance Minister Calls for Speedy Interventions in the Rollout of a Digital Euro

German Finance Minister, Olaf Scholz, sees the digital euro as an ideal innovation to meet the high demand for digital money from businesses and consumers in Europe.