Search Results for "state-owned investment funds"

Governments Are Considering Welcoming Bitcoin Investments, NYDIG CEO Reveals

In an interview with Real vision media firm, Robert Gutmann, the CEO of cryptocurrency investment firm NYDIG, has revealed that unnamed state-owned investment funds have been approaching the crypto investment firm with inquiries about making Bitcoin purchases.

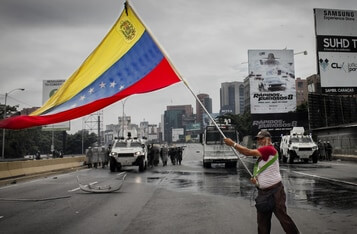

Chainalysis: Venezuela’s State-Owned Crypto Exchange Possibly Used by Maduro Regime to Launder Funds

Blockchain analysis company Chainalysis wanted to find out whether the claims of whether Petro aiding Venezuelans are true.

Investment Funds for 2020 | Index Funds Centralized Decentralized and the Blockchain

On the outset, this article has been written to put in perspective Index Funds as we know them, which new kind of Index Funds are developing with Cryptocurrencies (Digital Assets) and what developments are taking place in the Global Capital Markets with Blockchain developments.

Future of Index Funds

Inspired by traditional index funds' success, Crypto20 (C20) was designed to reinvent how investors gain exposure to the broader crypto market. With cryptocurrencies long-term growth potential, an index fund is the perfect entry point for investors looking to generate exceptional returns without taking on excessive risk.

Iconic Funds to Issue First Exchange Traded Product for Bitcoin on a Regulated Market

Iconic Funds, a global crypto asset management firm, has said it will issue an Exchange Traded Note (ETN) for Bitcoin of up to 100,000,000 Notes, tracking the NYSE Bitcoin Index (Ticker: NYXBT). The Notes may be subscribed to by qualified investors with both EUR and BTC, with a minimum subscription size of 100,000 Notes and an issue price of €1,00 per Note. Iconic Funds will apply for admission to trading of the Notes on the regulated market of the Luxembourg and Frankfurt Stock Exchanges in Q4 2019. The Notes will have a German ISIN.

Galaxy Digital Capital Management Launches Bitcoin Funds While Making Bakkt and Fidelity Custodians

Galaxy Digital Capital Management LP, an affiliate of Galaxy Digital Holdings Ltd, issued two Bitcoin funds with Bakkt and Fidelity Digital Assets as custodians for the funds, while Bloomberg L.P will be the pricing agent.

Thailand’s Bank of Ayudhya Unveils Blockchain-Based Platform for Cross-Border Funds Transfers

Smart contracts and blockchain play more of a key role in the economic and social growth of modern society. For example, Thailand’s Bank of Ayudhya demonstrates how the use of blockchain technology leverages cross-border funds transfers.

VanEck Makes the Case for Institutional Bitcoin Investment

VanEck has outlined the case for institutional Bitcoin (BTC) investment in a report published on Jan. 29. According to the investment management firm, even a small amount of BTC allocation could improve a portfolio's upside.

Belgium’s FSMA Blacklists More Crypto Investment Businesses Following Customer Complaints

Belgium’s Financial Services and Markets Authority (FSMA), a body mandated with the oversight and regulation of the nation’s financial services sector, has opted to add more crypto investment businesses to its blacklist for fraudulent activities. According to an official announcement, this decision was sparked by new cries aired by customers about cryptocurrency investment offers meant to swindle them.

Arca Digital Asset Investment Firm Gets Approval from SEC to Tokenize US Treasury Bonds

Los Angeles-based digital asset investment firm Arca has launched trading for its new digitized security investment product that runs on the Ethereum blockchain.

Wyoming State Says Cryptocurrency Represents Property, Allows Insurers to Include Digital Assets in Investment Portfolios

The US. state of Wyoming has enacted new legislation to allow insurance firms to invest in digital assets like cryptocurrencies. The new law intends to come into effect on 1st July.

Investors See Bitcoin as a Long-Term Investment, says Crypto Analyst

Despite the current price correction, on-chain analyst Willy Woo has revealed that Bitcoin’s velocity is higher than that of funds allocated for spending it.