Search Results for "nav"

United States Congress Agree on $900 Billion Stimulus Bill, What it Means for Bitcoin

United States Congress has reached an agreement on a proposed $900 billion pandemic stimulus package and will vote shortly, what will this mean for Bitcoin and crypto?

Ripple Donates $10M to Humanitarian Organization to Accelerate Financial Inclusion

Ripple has continued to be innovative in finding ways to deliver global financial inclusion amid a struggling COVID-19 economy.

Coronavirus Measures in China Delay Crypto Hardware for MicroBT and Bitmain Customers

The coronavirus is causing mass disruption throughout Asia and has now been declared a ‘global health emergency’ by the World Health Organisation. The Chinese government have taken drastic isolation measures and over 40 million people are effectively on lockdown. Two major crypto hardware manufacturers have been having difficulties servicing clients from their bases in China.

Gate.io Executive Reveals Global Economic Outlook and Future Cryptocurrency Adoption Amid Coronavirus Pandemic

Blockchain.News exclusively interviewed Marie Tatibouet, the Chief Marketing Officer of Gate.io to explore the current trends and future expected evolution of the cryptocurrency market.

World Sustainability Organization Adopts Blockchain-Based Virtual Audits to Curb COVID-19 Spread

With coronavirus (COVID-19) prevention measures necessitating self-isolation and social distancing, Friend of the Sea (FOS), a World Sustainability Organization’s project for seafood certification, has embraced blockchain-enabled virtual audits to mitigate the expansion of this pandemic. As a result, FOS has eradicated onsite scrutinies because safety is of the essence during these trying times.

Virgin Galactic CEO Rejects Coronavirus Bitcoin Bull Theory as “Idiotic”

Virgin Galactic CEO, Chamath Palihapitiya has dismissed the notion that the disruption to traditional markets caused by the coronavirus will serve as the catalyst for a major Bitcoin and cryptocurrency bull run.

Will Bitcoin Survive? IMF Predicts Worst Economy Since "Great Depression" in Aftermath of COVID-19 Global Lockdown

The International Monetary Fund (IMF) has released its quarterly World Economic Outlook for 2020 which paints a bleak picture on how the disruptive economic effects of the COVID-19 virus global quarantine measures, dubbed the ‘Great Lockdown’, will continue to cripple the markets long after the pandemic ends.

Algorand's Blockchain Based COVID-19 Global Survey Shares Real-Time Public Pandemic Data

Algorand, the first pure proof-of-stake (POS) blockchain created by cryptography pioneer and Turing award winner Silvio Micali, has launched a global Coronavirus (Covid-19) survey. The company published a blog post on March 27 announcing its ‘IReportCovid’ survey app. The aim of the survey is to compile a public database to share information on the spread, status, and symptoms of the COVID-19 pandemic and give updates in “real-time.”

EU’s Latest Coronavirus Recovery Deal: What’s Wrong with Fiat and What’s Right with Crypto

The recovery fund spearheaded by the EU is made up of €390 billion in grants and €360 billion in loans, which will be added to a new Multiannual Financial Framework (MFF), with the sum of €1.074 trillion as a seven-year budget. The heads of state and government have reached a unanimous agreement, resulting in a total financial package of €1.82 trillion.

EY-Led Consortium Submits Bid To Help Develop South Korea's CBDC

A consortium led by Ernst & Young has made the first and only bid to construct the business model for the Bank of Korea’s Central Bank Digital Currency project.

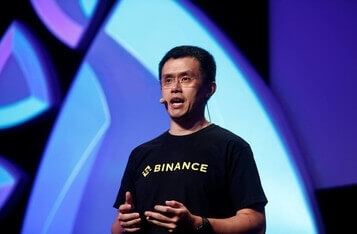

Binance Denies Sharing Users Data with Russian Intelligence Agencies

Binance exchange has denied allegations by Reuters that a Russian subsidiary has close ties to the country’s financial regulator called Rosfinmonitoring by agreeing with sharing users' data.

Billionaires and Bitcoin: Stan Druckenmiller’s Alarming Warning on Stocks While Paul Tudor Jones Remains Bullish on Bitcoin

Billionaire Stanley Druckenmiller said during a webcast held by The Economic Club of New York that the risk-reward calculation for equities is the worst he has ever seen in his career. The billionaire expressed his doubts about the US equities’ possibility of logging a V-shaped recovery. He added that government stimulus programs will not be enough for the economic recovery post-pandemic. Druckenmiller believes that cash liquidity required to pump assets that are considered risky will shrink shortly as the US Treasury will soon end the private economy which could overwhelm the Fed purchases through borrowing consistently.