Search Results for "debt"

Dai Stablecoin Reaches 100 Million in Debt Ceiling – An All-Time-High

The Dai (DAI) stablecoin reached the protocol’s built-in debt ceiling of 100 million as there has been 100 million Dai tokens minted. The nearly two-year-old stablecoin project had an original debt ceiling of 50 million, which was raised to 100 million in July 2018.

Exclusive | FUSANG CEO: CCB’s $3 Billion in Blockchain-Based Debt Bonds is Rise of Crypto 2.0

According to FUSANG CEO Henry Chong, the CCB's historic blockchain-based bond listing, the first tranche of $3 billion in debt, marks a transition into what he calls “Crypto 2.0”

MicroStrategy CEO Says the Software Firm Is Considering Equity or Debt Financing to Purchase More Bitcoins

MicroStrategy CEO Michael Saylor has said that he is considering issuing more debt to enable the company to buy more Bitcoins. He stated that it makes sense to purchase as much of the asset class as they can.

Emerging Markets Debt: Unlocking Potential in Overlooked Asset Class

Emerging markets debt (EMD) offers growth potential but remains under-allocated in fixed income portfolios, according to VanEck. Discover the challenges and opportunities in this asset class.

CoinFLEX to Sue Robert Ver to Recover $84m Outstanding Debt

CoinFLEX is facing bankruptcy fears after its big longtime crypto investor Roger Ver who failed to repay a debt now totals $84 million dollars. The exchange said they are taking legal action against Roger Ver.

Celsius is "Deeply Insolvent", Says Vermont's Financial Regulator

Vermont's Department of Financial Regulation also said that Celsius Network is also not honouring its obligations to customers and creditors as it does not have the assets and liquidity to do so.

The Issuance of a $1.5B Junk Bond by Coinbase Indicates Investors are Eager to Join Crypto

Coinbase's sale of a junk bond with a total value of $1.5 billion shows that cryptocurrencies have gradually become mainstream.

EquitiesFirst Owes $439 Million In Debt to Celsius Network

The case is one of many issues facing Celsius Network. If EquitiesFirst agrees to pay the debt, then the struggling Celsius’ operations would be bolstered.

Global Economy on Thin Ice: Slow Growth, High Uncertainty, Fragile Confidence

Global growth is slowing, with GDP forecasted to drop from low 3% to low 2% amid rising policy uncertainty and high inflation, leaving the economy fragile and cautious.

Bitvavo Rejects DCG's 70% Debt Repayment Offer

DCG's partial debt repayment plan was rejected by Bitvavo. The Dutch crypto exchange said it has adequate resources to keep servicing consumers. On Jan. 10, Cameron Winklevoss publicly accused DCG CEO Barry Silbert of fraud.

Latin America's Macro Crossroads: From Crisis Hangover to Nearshoring, Rate Cuts, and New Risks

Latin America is projected to grow 2% in 2024, driven by recovery in Argentina and Brazil. Inflation is down, with potential rate cuts ahead, but risks remain high.

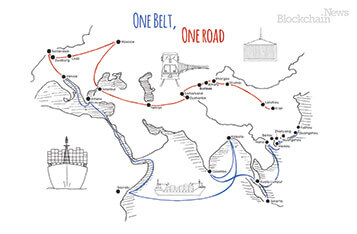

Belt and Road Initiative – Hong Kong the Gateway for RMB Internationalization

Many analysts have come to view BRI as a diplomatic offensive with geopolitical motives. However, the initiative is primarily driven by the Middle Kingdom’s pressing need to transform its national economy through further integration with the world.