Search Results for "blockchain-traded funds"

UK Fund Managers Urge Regulators to Approve Blockchain-Traded Funds

UK fund managers urge regulators to approve blockchain-traded funds, suggesting this move will help the UK in line with advances in the financial ecosystem.

Future of Index Funds

Inspired by traditional index funds' success, Crypto20 (C20) was designed to reinvent how investors gain exposure to the broader crypto market. With cryptocurrencies long-term growth potential, an index fund is the perfect entry point for investors looking to generate exceptional returns without taking on excessive risk.

Iconic Funds to Issue First Exchange Traded Product for Bitcoin on a Regulated Market

Iconic Funds, a global crypto asset management firm, has said it will issue an Exchange Traded Note (ETN) for Bitcoin of up to 100,000,000 Notes, tracking the NYSE Bitcoin Index (Ticker: NYXBT). The Notes may be subscribed to by qualified investors with both EUR and BTC, with a minimum subscription size of 100,000 Notes and an issue price of €1,00 per Note. Iconic Funds will apply for admission to trading of the Notes on the regulated market of the Luxembourg and Frankfurt Stock Exchanges in Q4 2019. The Notes will have a German ISIN.

Investment Funds for 2020 | Index Funds Centralized Decentralized and the Blockchain

On the outset, this article has been written to put in perspective Index Funds as we know them, which new kind of Index Funds are developing with Cryptocurrencies (Digital Assets) and what developments are taking place in the Global Capital Markets with Blockchain developments.

Texas Man Charged for Using COVID-19 Small Business Relief Funds to Buy Crypto

Texas resident Joshua Thomas Argires has been charged for investing COVID-19 relief funds in cryptocurrencies

Thailand’s Bank of Ayudhya Unveils Blockchain-Based Platform for Cross-Border Funds Transfers

Smart contracts and blockchain play more of a key role in the economic and social growth of modern society. For example, Thailand’s Bank of Ayudhya demonstrates how the use of blockchain technology leverages cross-border funds transfers.

Ernst and Young Unveil Blockchain Solution for Public Funds Management

This move by Ernest and Young is an accurate depiction of the boundless opportunities and possibilities inherent in Blockchain technology.

China is Expecting its First-Ever Blockchain Exchange-Traded Fund

Shenzhen is expecting its nation’s first exchange-traded fund (ETF) that will track blockchain-themed stocks as underlying assets.

Morgan Stanley Becomes First US Bank to Offer Bitcoin Funds to Its Clients

Morgan Stanley is offering its clients access to Bitcoin (BTC) investments.

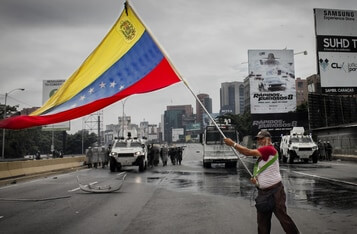

Chainalysis: Venezuela’s State-Owned Crypto Exchange Possibly Used by Maduro Regime to Launder Funds

Blockchain analysis company Chainalysis wanted to find out whether the claims of whether Petro aiding Venezuelans are true.

Bitcoin Subreddit Surges as Hedge Funds Short BTC, A Coordinated Crypto Buying Attack?

Will Bitcoin be the next target of a coordinated buying attack as new data reveals Bitcoin subreddit's astronomical growth as well as institutional shorts on the cryptocurrency?

CEO Of BTCS Explains How The Company Surpassed $1M In Crypto Assets

BTCS Inc. is a publicly-traded cryptocurrency and blockchain company that recently surpassed the $1 million milestone in crypto assets under management (AUM). The landmark achievement comes after crypto prices recovered from the mid-March slump (Black Thursday). Reports indicate that Bitcoin-focused crypto hedge funds are outperforming their more-traditional counterparts. BTCS plans to pursue a measured approach to diversifying its current cryptocurrency holdings. BTCS shares are up more than 215% year-to-date.