Ethereum Breaks Past $2,000 for the First Time as DeFi's Total Revenue Hits $800 Million

Brian Njuguna Feb 20, 2021 10:13

Ethereum (ETH) is on fire as it continues making record-breaking moves. Ether has broken the record by surging past the $2,000 mark across major exchanges.

Ethereum (ETH) is on fire as it continues making moves not seen in its 6-year history. Ether has broken the record by surging past the $2,000 mark across major exchanges.

The second cryptocurrency based on market capitalization is up by 8.94% in the last seven days and is trading at $2,013.00 at the time of writing, according to CoinMarketCap.

Crypto whales have been showing interest in Ethereum because addresses holding more than $10,000 ETH ballooned to1,287 on Valentine’s Day, which has been pivotal in boosting Ethereum's uptrend.

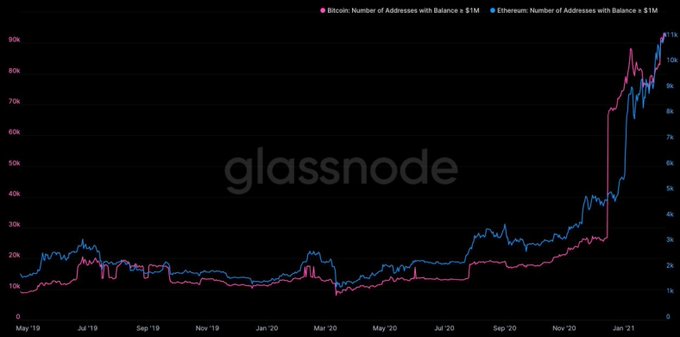

Yann & Jan, the co-founders of leading on-chain data provider Glassnode, has disclosed that there are currently at least 100,000 BTC and ETH addresses that hold more than $1 million.

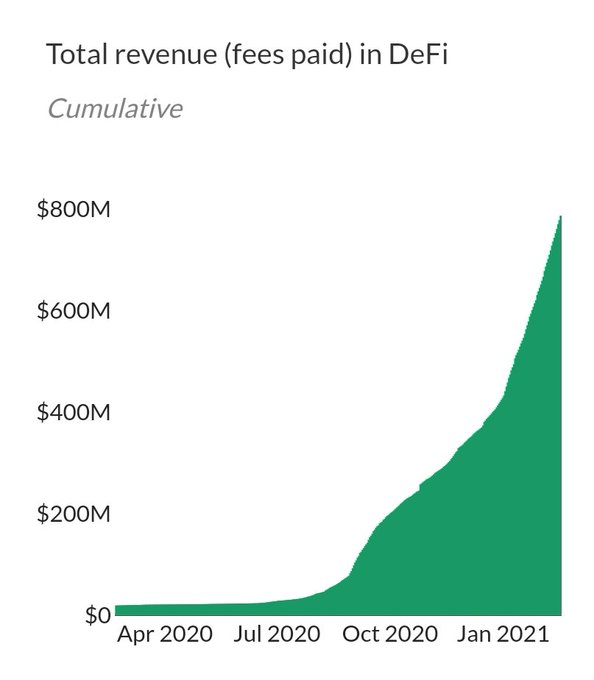

Total Revenue in DeFi Hits $800 Million in January

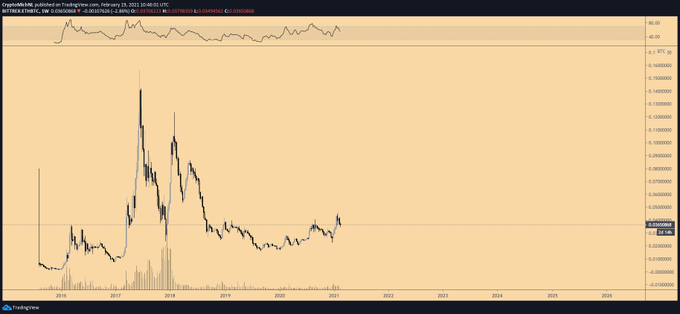

Ethereum’s present bull run is being boosted by ETH 2.0 going live in December 2021 amid a booming decentralized finance (DeFi) sector. ETH 2.0 offers a transition to the proof-of-stake consensus mechanism from the current proof-of-work as proof-of-stake protocols are deemed more environmental and cost-friendly.

DeFi is proving to be a force to be reckoned within the crypto space as it exploded and grew exponentially in 2020, with Ethereum benefitting from its rise in popularity.

Crypto trader Alex Kruger has taken to Twitter to disclose that the total fees paid in DeFi have soared to $800 million this month. He noted:

“Next time you hear someone say there is no real demand for crypto assets and how crypto is not productive, show him this.”

Michael van de Poppe, a crypto analyst, trusts that Ethereum is continuously showing bullish signals.

ETH has begun 2021 with a bang, and it seems that the sky is the limit because more institutional investors are keeping a keen eye on Ether, as evidenced by Grayscale’s Ethereum Trust portfolio of $6.1 billion, a figure that continues to grow by the day.

Image source: Shutterstock

.jpg)