Search Results for "state-owned investment funds"

Hedge Funds Were Net Short Bitcoin Futures Coming Into the Crash

According to the Block, hedge funds were inordinately short CME bitcoin futures compared to their peers the past week. So much so that net short positions among the hedge funds trading the product were at an all-time high the past two weeks.

Zambia SEC Warns Crypto Enthusiasts About Making Investments in Onyxcoin Cryptocurrency

The Securities and Exchange Commission in Zambia has issued a statement warning the general public that the creator of OnyxCoin Kwakoo is in no way a licensed investment advisor and should not solicit funds from within or outside the country. The CEO of the commission was reported to have made this statement.

Thailand’s Bank of Ayudhya Unveils Blockchain-Based Platform for Cross-Border Funds Transfers

Smart contracts and blockchain play more of a key role in the economic and social growth of modern society. For example, Thailand’s Bank of Ayudhya demonstrates how the use of blockchain technology leverages cross-border funds transfers.

JPMorgan says MassMutual Bitcoin Investment Signals Institutional Demand Could Quickly Grow by $600 Billion

JPMorgan thinks growing institutional demand could see up to $600 billion flow into Bitcoin in the near future after insurance giant MassMutual invested $100 million into BTC.

New York Man Charged with Defrauding Investors $4.5 Million in Cryptocurrency Investment Scheme

A New York man has been charged in US federal court with defrauding investors out of millions of dollars in crypto assets that he used on offshore gambling sites. A criminal complaint was filed on July 9, and the US Attorney’s Office charged Douglas Jae Woo Kim, 27 years old, with wire fraud in which he allegedly conned three investors out of over $4.5 million of Ethereum and Bitcoin.

Morgan Stanley Becomes First US Bank to Offer Bitcoin Funds to Its Clients

Morgan Stanley is offering its clients access to Bitcoin (BTC) investments.

VanEck Makes the Case for Institutional Bitcoin Investment

VanEck has outlined the case for institutional Bitcoin (BTC) investment in a report published on Jan. 29. According to the investment management firm, even a small amount of BTC allocation could improve a portfolio's upside.

Bitcoin Miners Are Not Selling But Accumulating Their Crypto Funds

Glassnode data shows that miners are not willing to sell their Bitcoins amid a market wide exchange shortage of the cryptocurrency. The shortage comes as institutions continue buying crypto assets in droves.

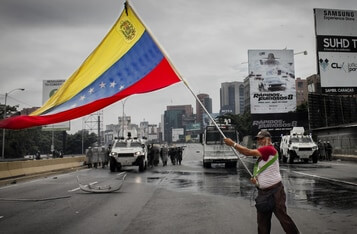

Chainalysis: Venezuela’s State-Owned Crypto Exchange Possibly Used by Maduro Regime to Launder Funds

Blockchain analysis company Chainalysis wanted to find out whether the claims of whether Petro aiding Venezuelans are true.

Grayscale Adds Five New Crypto Investment Trusts including One for Chainlink and Filecoin

Grayscale Investments has expanded its product line by launching new investment trusts including Chainlink, Filecoin, and Basic Attention Token.

Iconic Funds to Issue First Exchange Traded Product for Bitcoin on a Regulated Market

Iconic Funds, a global crypto asset management firm, has said it will issue an Exchange Traded Note (ETN) for Bitcoin of up to 100,000,000 Notes, tracking the NYSE Bitcoin Index (Ticker: NYXBT). The Notes may be subscribed to by qualified investors with both EUR and BTC, with a minimum subscription size of 100,000 Notes and an issue price of €1,00 per Note. Iconic Funds will apply for admission to trading of the Notes on the regulated market of the Luxembourg and Frankfurt Stock Exchanges in Q4 2019. The Notes will have a German ISIN.

Investment Funds for 2020 | Index Funds Centralized Decentralized and the Blockchain

On the outset, this article has been written to put in perspective Index Funds as we know them, which new kind of Index Funds are developing with Cryptocurrencies (Digital Assets) and what developments are taking place in the Global Capital Markets with Blockchain developments.