Search Results for "tokenize"

Tokenize the Future: What Tokenization Means For Financial Access

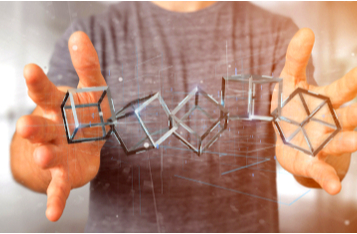

Thanks to advances in financial and blockchain technology, any tradeable asset can be digitally represented as a token and issued onto a blockchain creating greater access.

EY, Microsoft and ConsenSys Create a Platform For Enterprises on Ethereum Mainnet

Global accounting firm EY have launched their open-source Baseline protocol which aims to address privacy issues to encourage enterprise adoption of public Ethereum.

FUSANG Exchange Announces CCB $3 Billion Digital Bond Listing Suspended

FUSANG exchange announced that the listing of the $3 billion digital bond backed by China Construction Bank has been suspended.

Paxos—How the Global Financial Crisis Inspired the Creation of the NYDFS-Regulated Stablecoin

Charles Cascarilla is the CEO and co-founder of Paxos, a financial technology company working to modernize the financial system by digitizing and mobilizing assets. A traditional hedge fund manager and equity investor, Cascarilla was able to recognize the power of blockchain and the function it could have in revolutionizing the way trade is conducted and settled.

Atlético Madrid, AS Roma and OG Crypto Fan Token Prices Plunge Following Binance Listing

Champion Esports team OG (OG), Atlético Madrid (ATM) and AS Roma (ASR) crypto fan token prices have begun to plunge immediately after being listed on Binance.

FUSANG Exchange Lists First Publicly Available Blockchain-Based Digital Bond Backed by CCB

Asia’s first digital security exchange FUSANG is partnering with heavy weight China Construction Bank (CCB) to offer the first ever digital, tokenized, blockchain-based bond.

Blockchain Platform Owned by Russia’s Richest Man Gets Greenlight to Tokenize Air Tickets

Vladimir Potanin, arguably the richest man in Russia, has been granted permission to offer digital tokens to book air tickets, purchase metals, and transfer ski passes using his blockchain platform dubbed Atomyze. The much-needed go-ahead was given by the nation’s central bank last week based on Potanin’s urge to tokenize commodities from a consumer perspective.

tZERO Partners With Alliance Investments to Tokenize $25M Real Estate Project in UK

tZERO has announced that it has collaborated with Alliance Investments for the sole aim of tokenising River Plaza worth around $25 million.

ConsenSys Acquires US Brokerage Firm to Tokenize Outdated Municipal Bonds Market

ConsenSys has made a major acquisition of a U.S brokerage Firm to put traditional municipal bonds on the blockchain.

Arca Digital Asset Investment Firm Gets Approval from SEC to Tokenize US Treasury Bonds

Los Angeles-based digital asset investment firm Arca has launched trading for its new digitized security investment product that runs on the Ethereum blockchain.

DLA Piper: Security Tokenization in Hong Kong

Security tokenization is the representation of fractional interests in an asset using blockchain. A security token derives its value from an underlying asset, such as a work of art. This differs from a utility token, which gives a holder the right to use a particular product or service, or a cryptocurrency such as Bitcoin, which has its own value as a currency.

Digital Currencies and Tokenization Might be a Dominant Factor in the Future, says DBS CEO

Piyush Gupta, the CEO of Singaporean multinational banking corporation DBS, believes that the digital currencies and tokenization of assets is now a reality, which might be a dominant factor in the future.