Search Results for "share"

Bitmain Launches Cheaper Mining Machines After Bitcoin Halving and Losing Market Share to MicroBT

Bitmain has launched a cheaper version of a Bitcoin mining machine, Antminer T19, compared to its more pricy predecessor Antminer S19. Bitmain has been losing its market share to its rival, MicroBT, which launched its M30S++ Bitcoin miner in April this year. The Antminer T19 has a hashrate/ mining power of 84 terahash per second (TH/s), and power efficiency of 37.5 joules per terahash (J/TH). The price of this new mining machine is around $1750, while the S19 costs around $1785.

5 Legendary Investors Share Their Predictions About Bitcoin Prices

Bitcoin is emerging with the speed of lightning due to the rapid rise of technological advancements. What Bitcoin predictions have leading figures in the industry made?

European Crypto Miners Share Insights About Their Local Mining Industry

dGen, a non-profit research organization, in its report, has revealed that the cryptocurrency miners in the European region believe that Europe's higher electricity prices as compared to that of Russia and China is due to the strict regulation, strong protections, and political stability.

Head Chef Says DEX Aggregator Will 10x SushiSwap's Market Share

In a Jan 16 Medium article, Sushi CEO Jared Grey detailed the DeFi platform. A Q1 DEX aggregator and 2023 decentralized incubator are planned. After a Dec 6 governance proposal showed that Sushi's treasury had 1.5 years remaining, new offerings were proposed.

Digital Currency Group Announces $250M Share Buyback from Crypto Trusts

Digital Currency Group (DCG), the parent company of Grayscale Investments, has announced a new share buyback program projected to be worth $250 million.

Former Federal Reserve Chair Janet Yellen to speak at AFF, Global business leaders to share insights on economic challenges

Business leaders from around the world will gather in Hong Kong to share insights at the 13th Asian Financial Forum (AFF), which takes place on 13 and 14 January 2020 at the Hong Kong Convention and Exhibition Centre (HKCEC). Under the theme “Redefining Growth: Innovation ∙ Breakthrough ∙ Inclusiveness”, global financial experts, policymakers, business leaders and economists will examine topical issues in the global economy and explore new opportunities. This year’s AFF will feature discussions on a wide range of issues such as the new global economy, fintech, sustainable and inclusive development and green financing, offering participants a head start in identifying new economic challenges and opportunities.

China's Blockchain Initiative Hits Roadblock as Stakeholders Refuse to Share Private Data for Free

China’s blockchain initiative is going ahead full steam, but local and provincial officials are facing some resistance from stakeholders who are not enthusiastic about sharing their data.

Why Google Chrome Is Losing Market Share to Cryptocurrency-Powered Brave Browser

Google Chrome is losing some of its customers to the new Brave browser primarily because of the latter's privacy by default model and BAT token incentive.

Eastern Europe Hotbed For Darknet As Ransomware Activity Increases

A recent study from Chainalysis has found that darknet operators are responsible for a disproportionately large share of the crypto market in Eastern Europe.

Riot Blockchain Sees Growth in Q1 2020 Despite COVID-19 Disruption

Riot Blockchain Inc., one of the few listed public cryptocurrency mining companies in the United States on Nasdaq, reported financial results for Q1 of 2020, which ended on March 31. The company has seen a small growth in its earnings per share during this quarter. Riot Blockchain previously changed its name from Bioptix in 2017 after shifting its focus from biotechnology to Bitcoin mining. The company’s share price skyrocketed to a $38 high in late 2017, which then fell to $110 after Riot was accused of misleading investors by capitalizing on public interest in blockchain to drive up its share price. These claims have been dismissed on the basis that it was not proven that the company’s name was changed to drive up the share price.

Blockchain Can Make Patients Profit From Personal Health Data

Jim Nasr, a healthtech expert who is the Vice President of Technology and Innovation at Certara, has forecasted that blockchain could assist patients own, share, and monetize their own health data.

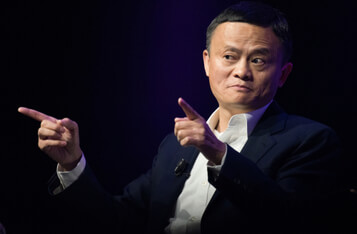

World's Largest IPO Ant Group to Raise $34.4 Billion, What is behind it?

Ant Group priced its dual listing on the Hong Kong Stock Exchange and Shanghai's Star Market at 80 Hong Kong dollars ($10.32) and 68.8 yuan ($10.26) per share respectively,