Search Results for "offering"

With Recent $9.5 million Offering BTCS Gains Institutional Investor Interest

BTCS, a digital asset blockchain technology-focused company, recently closed an institutional investor-backed $9.5 million financing comprised of 9,500,000 shares of its common stock and common stock warrants to purchase up to 7,125,000 shares of common stock at a combined purchase price of $1.00 per share in a registered direct offering.

Revenue from MicroStrategy’s $600M Private Offering Will Be Used to Buy Even More Bitcoin

MicroStrategy will host a $600M private offering and the revenue will be used to buy more Bitcoin.

MicroStrategy to Issue $400 Million in Securities Offering to Hoard More Bitcoin

Michael Saylor, the CEO of the billion dollar firm revealed that the firm plans to issue $400 million securities offering into Bitcoin.

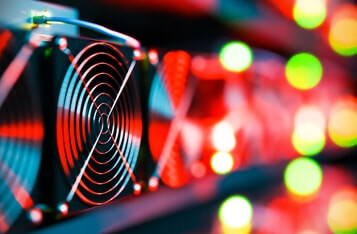

Largest North American Bitcoin Self-Mining Company, Marathon Announces $250 Million Registered Direct Offering of Common Stock

Marathon Patent Group, Inc. (Marathon) the largest enterprise Bitcoin mining company in North America announced a $250 million registered direct offering of common stock.

Ethereum Co-Founder Buterin’s Ether Sales More Like a Security Offering than XRP, Attorney Argues

In the Securities and Exchange Commission's lawsuit against Ripple Labs, many XRP proponents have argued that the cryptocurrency bears resemblance to Ethereum (ETH) and should therefore receive a similar regulatory treatment.

New Ride-Hailing App to Transform Payments by Offering Blockchain Direct Transactions

Bayride has revealed RideNode, a new transportation virtual and blockchain currency that seeks to transform the payment structures in this sector. America’s ride-hailing industry is touted to be revolutionized because RideNode will offer direct transactions between the service provider and consumers.

Russian Man Charged For Offering $1 Million in Bitcoin to United States Employee to Install Malware in Company’s Network

Russian citizen arrested and charged for trying to recruit an employee to plant malware on a company’s computer network in Nevada, US.

Chelsea Football Club Owner Abramovich Confirmed as Investor in Telegram's 2018 ICO

The US Securities and Exchange Commission’s (SEC) investigation into Telegram’s $1.7 billion initial coin offering (ICO) in 2018 has revealed that some very big names took part in the unregistered offering.

World's Second Largest Bitcoin Mining Company Raises $90M in US IPO

The world’s second-largest bitcoin mining equipment producer, Canaan Inc. raised $90 million during its initial public offering (IPO).

Chinese Bank Partially Owned by the Government Invests in Nervos STO

The Nervos Network security token offering (STO) has aimed to start on Oct. 16, to raise an undisclosed amount within two weeks via the CoinList platform.

Former HKEX Executive: Will HkbitEX Issue Its First STO Project Next Year?

On a forum, the Chief Development Officer of HKbitEX said that she hoped the company would issue its first security token offering (STO) project in 2021.

Tezos Settles Class-Action Lawsuit Over 2017 $232 Million ICO to the Tune of $25 Million

Tezos Foundation has settled for $25 million in a class-action lawsuit over its 2017 Initial Coin Offering (ICO) which raised $232 million.