Search Results for "share buyback"

XRP Status Classified as Unclear, Meanwhile Analysts Say XRP Price Could Jump to $0.30

The US Commodities and Futures Trading Commission (CFTC) Chairman Heath Tarbert indicated in an interview that the status of XRP has been classified as unclear. He said, “It’s unclear. Stay tuned I’d say. Part of the issue is that our jurisdiction we share with the SEC (Securities and Exchange Commission). If it’s a security, it falls under their jurisdiction. If it’s a commodity, it falls under ours.”

Bitcoin Dominance Hits 70% at 30-Month High While Altcoins are Dying

Bitcoin now accounts for just over 70 percent of the total cryptocurrency market capitalization as of September 3rd according to CoinMarketCap.

China's Blockchain Initiative Hits Roadblock as Stakeholders Refuse to Share Private Data for Free

China’s blockchain initiative is going ahead full steam, but local and provincial officials are facing some resistance from stakeholders who are not enthusiastic about sharing their data.

Eastern Europe Hotbed For Darknet As Ransomware Activity Increases

A recent study from Chainalysis has found that darknet operators are responsible for a disproportionately large share of the crypto market in Eastern Europe.

Christine Lagarde Announced EUR 750 Billion Bond Buyback, Bitcoin Surged 10%

With the launch of ECB's €750 Billion bond buyback, Bitcoin, in the last 24 hours witnessed a steep increase in price clocking at 16% growth.

Online interview with CEO of Block Chain Impact Hugo Jacques on blockchain advisory and investment

As Blockchain technology becoming more viable and prevalent, the number of accelerators and incubators to provide funding and servicing to this ecosystem had also increasing. We recently interview with the CEO of Block Chain Impact, Hugo Jacques. Who have wealth of experience in the ecosystem with investors and start ups, he share with us his experience and advice for anyone who want to enter into this field.

Ripple Blasted by Investor Tetragon for Playing “Word Games” in $175M Stock Buyback Lawsuit

Along with the heat Ripple is currently facing from the Securities and Exchange Commission, one of its leading investors has also turned against it.

Blockchain Adoption Wins Center Stage in Africa

Blockchain technology is continuously reigning supreme across the globe based on the distributed ledger network it avails, making transparency, immutability, and traceability inevitable.

Riot Blockchain Sees Growth in Q1 2020 Despite COVID-19 Disruption

Riot Blockchain Inc., one of the few listed public cryptocurrency mining companies in the United States on Nasdaq, reported financial results for Q1 of 2020, which ended on March 31. The company has seen a small growth in its earnings per share during this quarter. Riot Blockchain previously changed its name from Bioptix in 2017 after shifting its focus from biotechnology to Bitcoin mining. The company’s share price skyrocketed to a $38 high in late 2017, which then fell to $110 after Riot was accused of misleading investors by capitalizing on public interest in blockchain to drive up its share price. These claims have been dismissed on the basis that it was not proven that the company’s name was changed to drive up the share price.

Central Bank Digital Currencies Unmasked by Dr. Alicia Garcia-Herrero at Natixis

Blockchain.News has been delighted to reach out to Garcia-Herrero for her to share some thoughts on central bank digital currencies around the world. Central bank digital currencies (CBDCs) have increasingly sparked interest in recent years. With the notion of China’s central bank, People’s Bank of China (PBoC) announcing its plan to issue its digital currency (DCEP) and Facebook’s Libra stablecoin emergence, the world has been paying more attention to CBDCs.

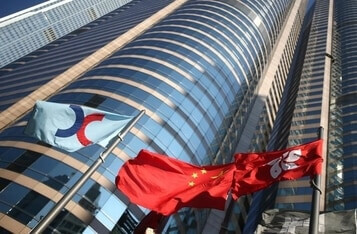

Breaking: London Stock Exchange Rejects £32B Takeover Offer from HKEX

Rejection of Conditional Proposal from HKEX

Six Central Banks Form Working Group to Assess Central Bank Digital Currencies

Six central banks around the world have come together to create a working group to share experiences on use cases on central bank digital currency (CBDC). With significant expertise in exploring digital currencies, these six central banks are the Bank of Canada, Bank of England, Bank of Japan, European Central bank, Sveriges Riksbank in Sweden, and the Swiss National Bank, and the Bank of International Settlements (BIS).