Search Results for "insurance"

Gemini Launches Insurance Company Resulting in the Highest Custody Insurance Coverage in the Crypto Market

Gemini exchange excitedly announced the launch of its own cryptocurrency insurance company which turned out to be regarded as the most crypto custody with the widest coverage at the moment. Named Nakamoto, Ltd.

Traditional Financial Giant Lloyd's of London Introduces Cryptocurrency Insurance for Hot Wallets

Insurance giant Lloyd’s has launched a new insurance product to protect digital asset holders against the rising threat of cybercrime in the crypto market.

Coincover Sets Eyes on Crypto-based Insurance Service

Coincover, a Cardiff based start-up in the United Kingdom, has gone a notch higher by introducing a crypto-based insurance service. The primary objective of this move is deterring asset loss and theft in the cryptocurrency space.

EToro Boosts Insurance Cover-Up to £1 Million, but Crypto Investments Excluded

eToro has unveiled a new insurance plan that will cover up to 1 million euro for customers, but cryptoassets are excluded from the policy.

Oxfam's Blockchain-Based Agricultural Insurance Firms in Sri Lanka Pay Farmers with Crypto

Insurance in the agricultural sector is becoming digitized through blockchain based solutions in Sri Lanka as Oxfam pays farmers in cryptocurrencies

Hackers Demand $1 Million in Bitcoin Ransom After Hacking Computer Systems of Insurance Firm

Israeli’s largest insurance company fell victim to hackers this week and must pay huge amounts of funds in cryptocurrency to regain access to its data.

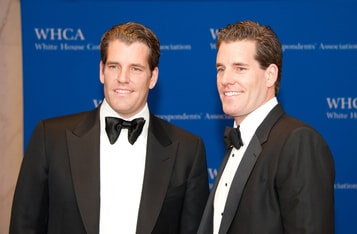

Tyler Winklevoss Predicts $500K BTC price as MassMutual Insurance Giant Buys up $100 million in Bitcoin

MassMutual Insurance buys up $100 million in BTC for its portfolio, and Bitcoin billionaire Tyler Winklevoss appears to be gaining confidence in his $500,000 per BTC prediction.

Fitch Warns El Salvador’s Bitcoin Adoption Will Hurt Local Insurers’ Credit Ratings

Fitch Ratings has warned El Salvador that its bitcoin adoption plan poses serious risks to local insurance companies.

Lemonade to Offer Blockchain-Powered Climate Insurance for Farmers in Emerging Markets

American insurance company Lemonade has revealed the formation of Lemonade Crypto Climate Coalition which will offer blockchain-enabled climate insurance to the most vulnerable farmers across the globe.

Ensuro Leverages USDC to Enhance Insurance Accessibility for Underserved Populations

Ensuro, using USDC, is revolutionizing insurance by making it more inclusive and capital efficient, especially for underserved populations.

Zetrix Announces Launch of NFT-based Insurance Product Covinsure

Public blockchain network Zetrix announced the launch of Covinsure, an NFT-based insurance product.

How Blockchain Technology is Helping to Fight the Novel COVID-19 Pandemic

Coronavirus disease has changed our lives in unprecedented ways. With the imminent lockdown caused by the virus, several reorganizations had to be implemented to keep our lives going. This brief analysis highlights some of the key ways that the application of Blockchain Technology is helping in the fight against the COVID-19 disease and pandemic.