Search Results for "asset digitization"

MINAX and MOVA Public Chain Announce Strategic Partnership to Power a New RWA-on-Chain Ecosystem for Global Brands

On August 29, during Bitcoin Asia 2025 in Hong Kong, MINAX Global Brand Exchange and the MOVA public chain announced a strategic partnership to accelerate the tokenization, issuance, and secondary trading of brand-based Real-World Assets (RWA). The collaboration aims to provide new momentum for the digital transformation of global brand assets.

Chinese Bank Issues the First Asset-Backed Commercial Paper in China on Blockchain

China Zheshang Bank, based in Zhejiang province has leveraged blockchain technology to issue the country’s first asset-backed commercial paper in the Chinese financial market. China Zheshang Bank successfully issued the “Lianxin 2020 Lianjie First Phase Asset-backed Commercial Paper,” which was worth 120 billion yuan ($16.93 billion). The asset-backed commercial paper (ABCP) was issued as a part of the National Association of Financial Market Institutional Investors’ (NAFMII) pilot project. ABCPs are short-term investments issued by financial institutions to support companies in their short-term goals.

Understanding Digital Asset-Backed Securities: Why is Blockchain Important?

In the second part of our interview with Florian Matthaeus Spiegl of FinFabrik, he explained how FinFabrik helps tackle challenges for many traditional financial services companies, and how the industry can work together to build more inclusive, accessible and efficient systems.

Meet the FinTech Entrepreneur: Co-Founder of FinFabrik, Florian Matthaeus Spiegl

There has been a lack of innovation and digitization in the capital market systems, we sat down with Florian Spiegl, the Chief Operating Officer of FinFabrik in Hong Kong, to explore his journey from the traditional capital markets industry to the new modern digital space. FinFabrik, a start-up focused on bridging the gap between the traditional financial markets and the digitization of assets has come a long way helping institutions to digitize illiquid and alternative assets.

Banking on Blockchain: FinTech and Digitalization Will Play a Significant Role for the Chinese Banking Industry

China’s banking industry for small to medium-sized enterprises (SMEs) will rely on digitization and financial technology to build a “new infrastructure” for the entire industry. Highly endorsed by the country’s president, Xi Jinping, blockchain technology has seen a surge in popularity in the past year.

The World Economic Forum Highlighted Blockchain and Digitization to Address COVID-19 Supply Chain Disruption

The World Economic Forum (WEF) published a report on the importance of blockchain in supply chain disruption amid the coronavirus pandemic. Although the report suggested that blockchain may not be able to support the damage caused by the impact of COVID-19 directly, it may help with supply chain visibility.

China’s Central Bank Official Urges the Acceleration of Digitization of the Chinese Economy with Blockchain

China’s central bank, the People’s Bank of China (PBoC) Financial Technology Committee held its first meeting of the year this week, after months of delay due to the coronavirus pandemic. Fan Yifei, the PBoC’s deputy governor echoed President Xi Jinping’s call for the acceleration of the country’s blockchain development adoption. The president pointed out that it is necessary to strengthen fundamental research of blockchain technology and enhance innovation, enabling China to take a leading position in the blockchain field. The bank’s deputy governor met with the central bank’s officials as well as the heads of their affiliated financial institutions. Fan emphasized the importance of blockchain and financial technology (FinTech) industries and wanted to ensure China’s adoption plan would be laid out and implemented by 2021 to be in line with the deadline they have set out.

Is Bitcoin the Best Asset to Hold? Gold Bull Jeffrey Gundlach Calls BTC "The Stimulus Asset"

Jeffery Gundlach, a self-proclaimed gold bull has acknowledged that Bitcoin may be the stimulus asset.

$115 Million in Bitcoin Was Acquired by an Asset Manager as its Primary Treasury Reserve Asset

Stone Ridge Asset Management, home to $13 billion in assets under management (AUM) has recently purchased $115 million in Bitcoin.

Kraken Brings Crypto Asset Liquidity to Skrill and Neteller

Paysafe, a leading specialized payments platform has chosen US-based cryptocurrency exchange Kraken as their crypto asset liquidity provider.

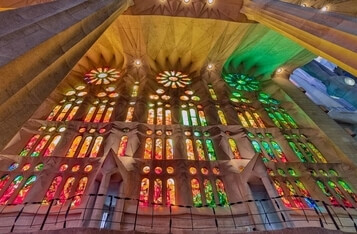

BME Rolls Out Blockchain-Powered Collateral Pledge Certificates

BME, a Spain-based stock market operator, has established a service dubbed BE DLT-Preda that deploys blockchain technology in the digitization of collateral pledge certificates. This, therefore, eradicates the urge for physical documents.

Why Hong Kong Will Be a Leading Digital Asset Trading Centre in Asia

Reasons why Hong Kong will a leading digital asset trading centre in Asia.