Non-Zero Bitcoin Addresses Hit ATH as Illiquid Supply Sees Major Growth

Brian Njuguna Dec 22, 2021 06:25

More participants continue to join the Bitcoin (BTC) network despite continued consolidation.

More participants continue to join the Bitcoin (BTC) network despite the continued consolidation between the $46K and $50K range.

Educational platform On-Chain College confirmed:

“Bitcoin addresses with a non-zero balance chart continue to make ATHs, now just under 39.5M.”

This, coupled with the fact that Bitcoin’s illiquid supply is experiencing significant growth, are bullish signs. A Glassnode analyst under the pseudonym TXMC explained:

“Illiquid Supply, the corn held by strong hands, has been one of the remarkable narratives for Bitcoin in 2021. Following the May wipeout, these HODLers were the first to begin stacking again. Illiquid Supply growth is currently outpacing coin issuance by a factor of 3.4x.”

A surge in non-zero addresses shows that the demand for the benchmark cryptocurrency is increasing.

Given that illiquid supply is growing 3.4 times faster than coins mined, then a supply deficit is being experienced in the Bitcoin market, this is bullish based on market forces because an increase in demand and a reduction in supply usually prompts a price surge.

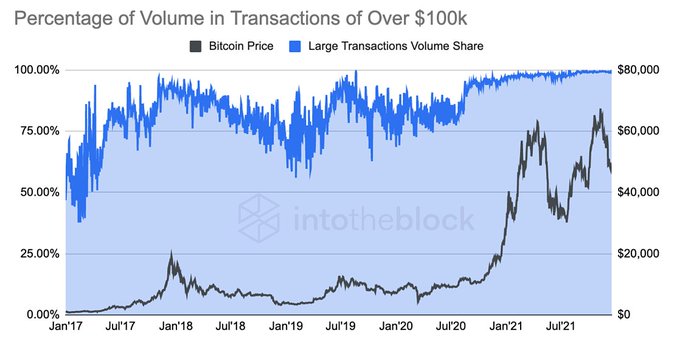

Meanwhile, the percentage of transactions above $100,000 reached historic highs of 99.3% in the fourth quarter of this year. Crypto insight provider IntoTheBlock noted:

“The percentage of Bitcoin's total volume being managed by institutions and whales reached record levels of 99.3% in the fourth quarter of 2021. This is up from 97.5% in the first quarter of the year and 58% in the first quarter of 2017.”

This correlates with the fact that Bitcoin’s institutionalization increased four-fold in November and hit a weekly average of $1.9 trillion.

Institutional investments have played an instrumental role in Bitcoin’s notable growth this year. For instance, American business intelligence firm MicroStrategy recently bought an extra 7,002 Bitcoins, bringing its portfolio to more than 121,000 BTC.

Image source: Shutterstock

.jpg)