Search Results for "management"

Italian Town Spearheads Blockchain-Propelled Waste Management

Miglianico, an Italian town in the Abruzzo region, is famous for its wine production based on its expansive vineyards. The city is planning to establish a new blockchain breakthrough by being the first town in the country to incorporate distributed digital ledger technology for its waste management solutions.

How Does Blockchain Enhance Traditional Project Management?

Projects are very different from every other type of activity; they have a definite beginning, ending and time frame. They are created or initiated to fulfill a specific objective, which after fulfilling they cease to exist. But did you know that 7 out of ten projects overrun their deadlines? How can blockchain enhance the process of project management?

Blockchain as a Solution for Data Management in Clinical Trials

Applying blockchain technology to clinical trials can help resolve one of the industry's biggest weaknesses: Poor data management. Learn how blockchain's immutability trait can become a trial investigator's best asset.

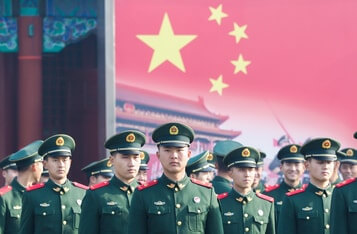

Chinese Military Likely to Employ Blockchain Management to Improve Performance

A report on Nov. 18 from the Chinese media Global Times, has stated that the Chinese military is likely to adopt blockchain technology to ensure proper management of personnel data, improve their training and performance in mission.

How Blockchain is Prompting Innovations in Waste Management

Blockchain can come in handy in the realization of efficient waste management measures through the creation of a trustworthy, transparent, and immutable supply chain network for a plethora of different records. This technology can aid in the digital tracking of information, allowing an in-depth analysis of supply chains.

Bitcoin Is at an “Inflection Point,” says Soros Fund Management CIO

As Bitcoin’s price consolidation continues, Soros Fund Management CIO Dawn Fitzpatrick believes that the leading cryptocurrency is at an inflection point.

Singapore Employs Blockchain-Enabled Digital Health Passport for Enhanced Medical Data Management

The Singaporean administration teamed up with a local startup to establish a blockchain-powered digital health passport to boost medical records management.

BlackRock Filings Signal the Giant Asset Management Firm Could Start Bitcoin Futures Trading

Blackrock investment management giant has filed documents with the SEC suggesting that the firm is set to dive into the crypto futures trading.

Mongolia’s Oldest Bank Will Soon Offer Comprehensive Crypto Services

Mongolia’s Trade & Development Bank (TDB Bank), one of the oldest and largest banks in the nation, has announced plans to enter the crypto space.

How Blockchain Will Break Down Barriers to Asset Management?

To tackle issues like global inequality, blockchain is believed one of the ways to break down barriers to asset management among traditional finance sector.

Galaxy Digital Capital Management Launches Bitcoin Funds While Making Bakkt and Fidelity Custodians

Galaxy Digital Capital Management LP, an affiliate of Galaxy Digital Holdings Ltd, issued two Bitcoin funds with Bakkt and Fidelity Digital Assets as custodians for the funds, while Bloomberg L.P will be the pricing agent.

3 Platforms Making DeFi More Inclusive

Decentralized finance (DeFi) is taking the world by storm. Owners of cryptocurrencies can unlock an alternative financial system that offers better rewards than traditional bank accounts and carries more risk. Several trends in the DeFi space are emerging lately, as are the new protocols trying to capitalize on this momentum.