Search Results for "diversification"

Global Supply Chain Financing: A New Era of Resilience and Diversification

Citi's 2024 report on supply chain financing highlights a shift towards resilience and diversification in global trade, emphasizing technological innovations and the adoption of the China Plus One strategy.

Diversification in Commodities: Precious Metals Lead Q3 Gains

Gold and silver drive Q3 commodity gains amid central bank buying. Diversification across sectors is crucial for sustained long-term performance, according to VanEck.

Long-Term Investment Strategies for 2025: Navigating Fed Rate Uncertainty, Inflation, and Market Volatility

In 2025, investors should diversify portfolios, focus on resilient sectors, and stay alert to Fed signals amid rate uncertainty and persistent inflation.

MakerDAO Increases US Treasury Bond Holdings by 150%

MakerDAO passed a proposal to increase its US Treasury bond holdings by 150% to $1.25 billion. The move aims to diversify its liquid assets and boost revenue stream through a net annualized yield of 4.6% to 4.5%. The bonds will be purchased with equal maturities over a six-month period.

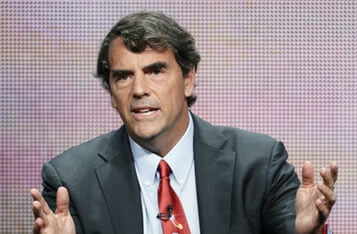

"Tim Draper's Bitcoin Diversification Advice"

Venture capitalist Tim Draper advises business founders to diversify their cash holdings by keeping at least two payrolls worth of cash in Bitcoin or alternative cryptocurrencies, along with other recommendations, in response to the uncertainty created by the collapse of Silicon Valley Bank.

Blockchain.News Interview with Co-founder and CIO of CryptAM, David Demmer on Digital Asset Management

We conducted an interview with the Founder and CIO of CryptAM, a Fintech firm that offer high net-worth and institutional investors access and diversification into the digital asset market. He also shared with us his views and insights on the current digital asset landscape.

BTCS Crypto Portfolio Expands Over 280% in Q2 2020 Amid COVID-19 Pandemic

While many institutions struggled to recover from the market downturn experienced in March, publicly-traded, blockchain-focused firm BTCS Inc. (OTCQB: BTCS) has increased its portfolio by 285 percent in Q2 2020, through well-timed investments in both bitcoin (BTC) and ether (ETH), and crossed the $1 million mark for cryptocurrency assets under management (AUM).

Grayscale Announces the Launch of its Diversified Crypto Investment System for Trading

Grayscale Investments, the American-based crypto management fund, announced a plan to launch its diversified crypto investment system for trading. This investment product is known as Grayscale Digital Large Cap Fund (GDLCF), and trading will begin in no distant time with access to US securities.

Uber CEO Reveals the Firm Will Consider Accepting Bitcoin as Payment

Uber CEO has said that the company is open to accept Bitcoin as a means of payment, but won’t purchase the cryptocurrency for its corporate balance sheet.

Bitwise and ETF Trends : 64% of US Financial Advisors expect Bitcoin Price to Appreciate Over Next 5 years

Around half of all wealth in America is managed by financial advisors, but how much of that wealth are they comfortable allocating to cryptoassets?

Ripple CEO: Global Governments Now See Blockchain Solution to Addressing Transparency and Settlement

Brad Garlinghouse, Ripple CEO, believes most governments consider blockchain technology a game-changer as it solves frictions like transparency and settlement that were a headache in yesteryears.

MUFG Seeks Seamless Automatic Securities Settlement via Blockchain

MUFG (Mitsubishi UFJ Financial Group), one of Japan’s biggest banking institutions, has announced the establishment of an ST (Security Token) Research Consortium intended at protecting investors’ rights, as well as offering fund settlement and seamless automatic securities settlement via blockchain.