NFTs will Outrun Bitcoin due to the Proof of Ownership for Real-World Items, Kevin O’Leary says

Brian Njuguna Jan 06, 2022 10:05

Kevin O’Leary believes that NFTs have a bigger shot of surpassing Bitcoin because they can digitally show ownership of real-world things like flash cars or designer watches.

Shark Tank investor and Chairman of O’Shares Investment Advisers, Kevin O’Leary, believes that non-fungible tokens (NFTs) have a bigger shot of surpassing Bitcoin because they can digitally show ownership of real-world things like flash cars or designer watches.

Speaking on CNBC’s Capital Connection Wednesday, O’Leary revealed his bullish sentiments about NFTs and stated:

“You’re going to see a lot of movement in terms of doing authentication and insurance policies and real estate transfer taxes all online over the next few years, making NFTs a much bigger, more fluid market potentially than just bitcoin alone.”

Nevertheless, he disclosed that he was investing on both sides of the equation.

O’Leary’s latest suggestion is a change of tune because he was previously a heavy critic of cryptocurrencies, even at one time calling Bitcoin “garbage” in 2019.

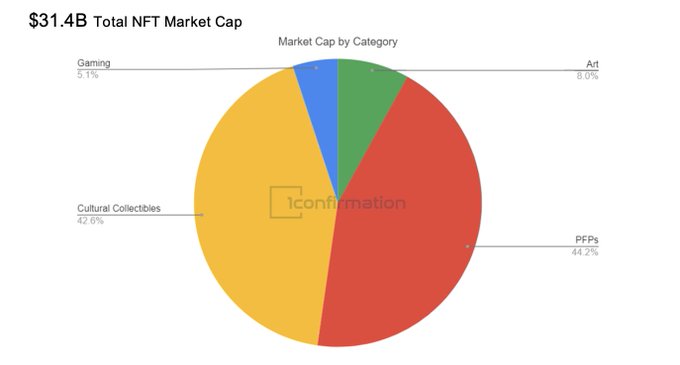

NFTs continue taking cutting-edge influence on the world, given that their total market capitalization stood at $31.6 billion at the close of 2021.

NFTs are digital assets whose ownership is blockchain-based. Furthermore, their value is pegged on their uniqueness.

An NFT is different from a typical crypto token because of fungibility. A fungible token can be exchanged for another, whereas a non-fungible token (NFT) cannot be based on its finite nature. Moreover, NFTs are non-divisible because they have to be bought wholly. For cryptocurrencies like Bitcoin, a fraction of them can be bought, but this is not possible with an NFT.

Therefore, these traits create the intrinsic value for NFTs because of their limited supply and the fact that they are acquired as an entire token.

Some of the most common use-cases of NFTs include event tickets, game items, digital collectables, software licensing, digital certificates, in-game props, authentication certificates, and domain names.

In September last year, William Quigley, the co-founder of stablecoin Tether (USDT), opined that NFTs could become the revenue model of the metaverse.

Image source: Shutterstock

.jpg)