Ethereum Surges Past $1,800 - What's Next?

Brian Njuguna Apr 01, 2021 01:24

On-chain metrics provider Santiment has noted that Ethereum's price surge to above $1,800 has triggered crowd skepticism, but this is a bullish sign.

Ethereum (ETH) is a stone’s throw away from its all-time high (ATH) price of 2,000. The second-largest cryptocurrency based on market capitalization is hovering around the $1,937 price at the time of writing, according to CoinMarketCap.

Santiment has noted that this price surge has triggered crowd skepticism, but this is a bullish sign. The on-chain metrics provider explained:

“Ethereum has wobbled its way back above $1,800, and the crowd has serious doubts on whether it'll last. This extreme level of crowd skepticism is historically bullish for crypto coins.”

This renewed ETH upsurge is backed by varying bullish fundamentals, the latest of which is the announcement by Visa Inc., the payment services giant, who chose to settle USDC transactions using the Ethereum Blockchain.

Moreover, more participants have been joining the ETH network, as alluded to by on-chain data provider Glassnode that Ethereum addresses holding more than one coin have hit a new ATH of 1,202,746.

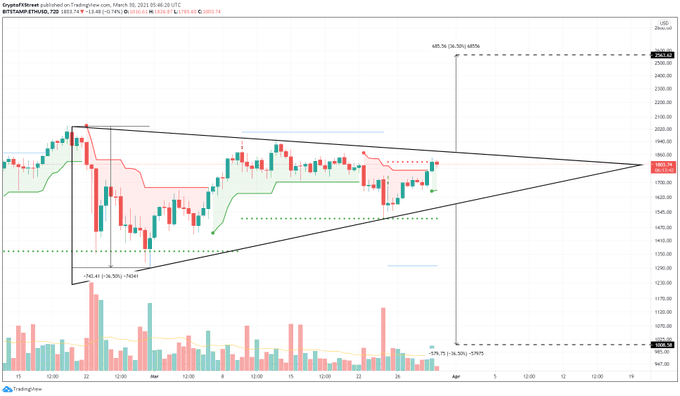

Ethereum eyes the $2,500 price level

According to crypto metrics provider FXScrypto:

“Ethereum to target a 36% move in case of triangle breakout, ETH/USD projects target of $2,563 on potential rally while IntoTheBlock’s IOMAP reveals lack of resistance levels ahead.”

If this is accomplished, $2,500 will emerge as the new ATH, even though market analyst Michael van de Poppe believes that a price of $5,000 will be inevitable for the second-leading cryptocurrency.

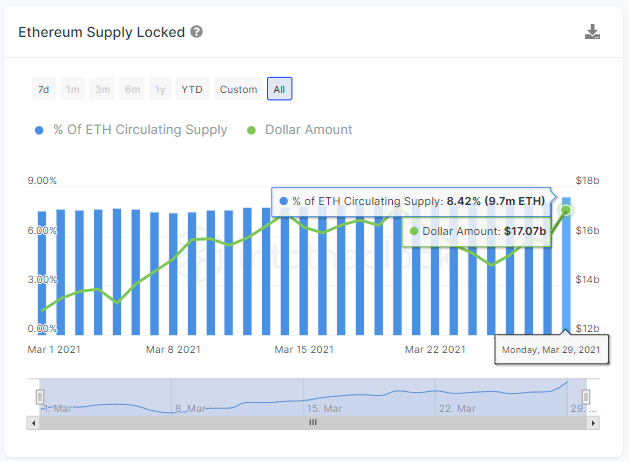

Moreover, the amount of Ethereum locked in decentralized finance (DeFi) protocols recently reached a 30-day high at 9.7 million.

This figure represents 8.42% of the circulating ETH supply. DeFi has played a pivotal role in Ethereum’s bull run as some of its products like smart contracts are in high demand in this sector. ETH, however, has to get an amicable solution to its high gas fees because they have been detrimental to its continued growth.

Image source: Shutterstock

.jpg)