Bitcoin Scarcity Scales the High as Illiquid Supply Hits 85% in the Last Three Months

Brian Njuguna Oct 08, 2021 10:00

92% of Bitcoin supply hasn't moved in at least 30 days and 85% of this has been immobile for at least 3 months.

Bitcoin (BTC) is back to winning ways because it continues to top the $55K level, a scenario last occurred in May. The leading cryptocurrency was up by 2.48% in the last 24 hours to hit $55,607 during intraday trading, according to CoinMarketCap.

This price surge is partly being triggered by scarcity in the BTC market. On-chain analyst Will Clemente explained:

“An estimated 38.2% of BTC supply is lost. 92% of supply hasn't moved in at least 30 days. 85% of supply hasn't moved in at least 90 days. The scarcity of Bitcoin cannot be overstated.”

Therefore, illiquid or immobile Bitcoin supply has skyrocketed and based on market forces, if supply decreases and demand increases, price is expected to rise.

Clemente acknowledged that the estimation of lost or immobile coins is done by subtracting liveliness (ratio of coin days created/destroyed) from 1 and multiplying that value by circulating supply.

Online services are propelling BTC Lightning network usage

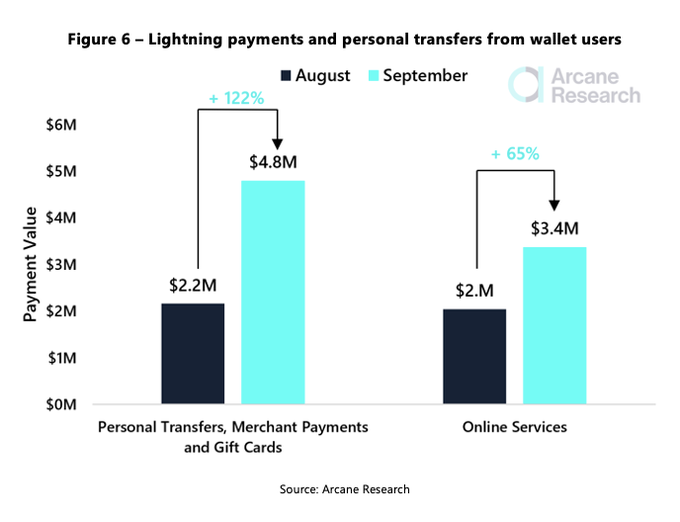

According to crypto analytic firm Arcane Research:

“Lightning usage is pivoting from being dominated by online services to everyday use. The step from users with access to Lightning payments to actual Lightning usage is not instant of the same magnitude. Nonetheless, spending from commonly used wallets doubled in September.”

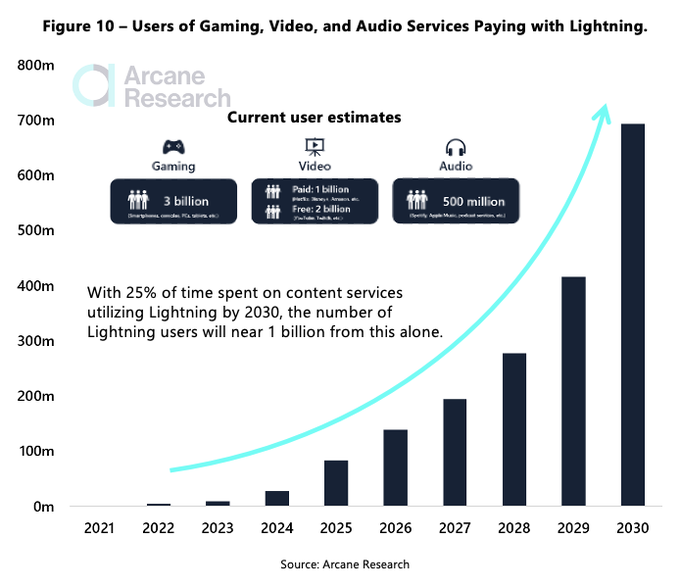

Arcane Research acknowledged that the Lightning Network could radically change the business model of content providers in gaming, video, audio, and many more categories by providing a structure where continuous micropayments are made.

The Bitcoin Lightning Network capacity recently breached 3,000 BTC for the first time.

This network is a second layer incorporated into the Bitcoin blockchain to undertake off-chain transactions. As a result, micropayment channels are utilized to scale the blockchain’s capacity to carry out transactions more efficiently.

Therefore, transactions on lightning networks are believed more readily confirmed, cheaper, and faster than that processed on-chain or Bitcoin mainnet.

Image source: Shutterstock

.jpg)