Long-Term Holder Supply Shock Ratio Breaks Record as Bitcoin's Price Hits 6-Month High of $60K

On-chain analyst Will Clemente believes the next few months will be wild to Bitcoin, given that the long-term holder supply shock ratio is at an all-time high (ATH).

Bitcoin (BTC) briefly breached the $60,000 level for the first time since April as its upward momentum continues. However, the benchmark cryptocurrency had retraced to the $59,033 area during intraday trading, according to CoinMarketCap.

On-chain analyst Will Clemente believes the next few months will be wild to Bitcoin, given that the long-term holder supply shock ratio is at an all-time high (ATH). He said:

“Long-term holder Supply Shock ratio is now clearly at the highest it's ever been. These next few months are going to be wild.”

Therefore, this shows an imminent supply squeeze in the Bitcoin market. The leading cryptocurrency’s scarcity has been scaling the heights because illiquid or immobile supply recently reached 85% in the last three months.

As a result, if supply decreases and demand increases, price is expected to rise based on market forces.

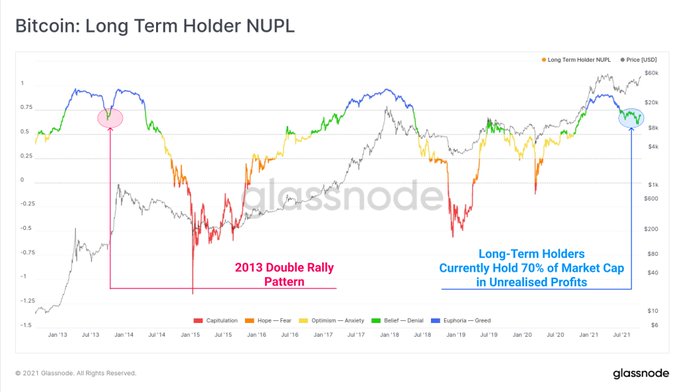

Long-term holders are notable players in the Bitcoin ecosystem because they hold 70% of the market capitalization. Crypto analytic firm Glassnode explained:

“As Bitcoin breaks above $59K, Long-Term Holders have returned to impressive unrealized profits. The LTH cohort currently holds 70% of the market cap in unrealized gains. If this metric rallies above 75%, it would start to resemble the 2013 double rally scenario.”

Who are the biggest drivers of the current rally?

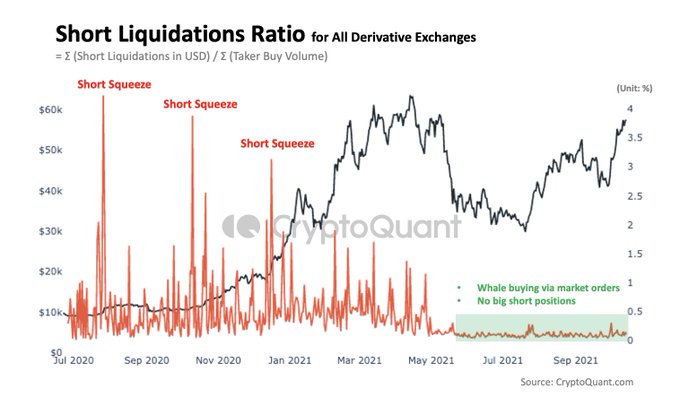

According to Ki Young Ju, the CEO of CryptoQuant, BTC whales have been the engine behind the present price surge. He indicated:

“This rally has been driven by whale buying, not short squeeze. Massive BTC buying market orders in derivative exchanges are not from short liquidations. This indicates: 1. There are no big short positions liquidated so far. 2. Whales punted long positions since the dip.”

Market analyst Jan Wuestenfeld echoed these sentiments and added:

“Not only is whale activity on-chain increasing, but the 7-day moving average of the number of active Bitcoin addresses is trending upwards as well.”

With Bitcoin’s price being a stone’s throw away from a record high of $64,800, time will tell whether it will be breached.

Image source: Shutterstock

.jpg)