Ethereum Open Interest Hits All-Time High as 100% of ETH Addresses in Profit

Ethereum open interest hits an all-time-high and 100% of ETH addresses are now in profit.

It was a matter of when not if Ethereum (ETH) was going to hit its all-time high (ATH) price of $1,400 as previously predicted by analysts. ETH made a notable milestone of surging to $1,432 yesterday even though it has retraced to $1,350 at the time of writing, according to CoinMarketCap.

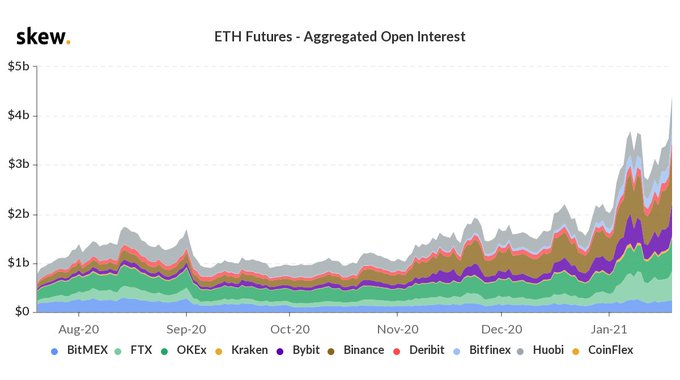

The current Ethereum bull run commensurates with the open interest of more than $4 billion its network is witnessing as acknowledged by unfolded. The market insight provider noted:

“Ethereum open interest hits all-time-high.”

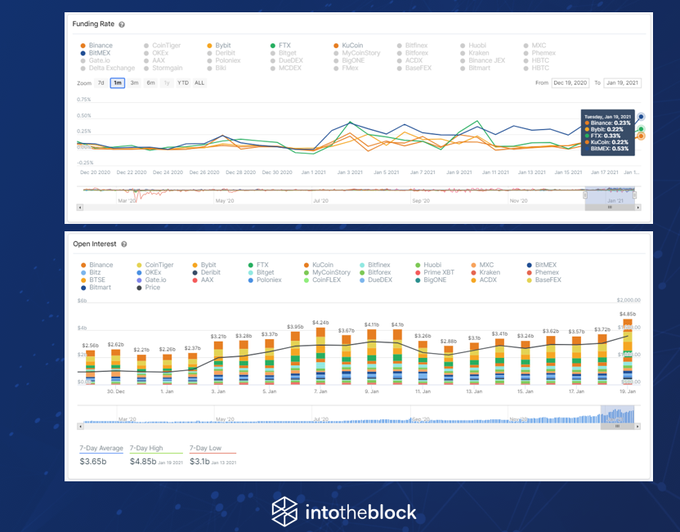

Another on-chain data provider IntoTheBlock has also stipulated that the ETH market is overleveraged. Precisely:

“The market is overleveraged. The Ethereum perpetual swaps funding rate is currently above 0.22% across several exchanges and going as high as 0.5% on BitMex.”

Ethereum addresses are cashing in

With Ethereum’s daily transaction volume going parabolic and surpassing Bitcoin by $3 billion, it was a matter of time before ETH hodlers smiled all the way to the bank, as alluded by Rafael Schultze-Kraft. The on-chain analyst stated:

“100% of addresses holding ETH in profit – everybody happy.”

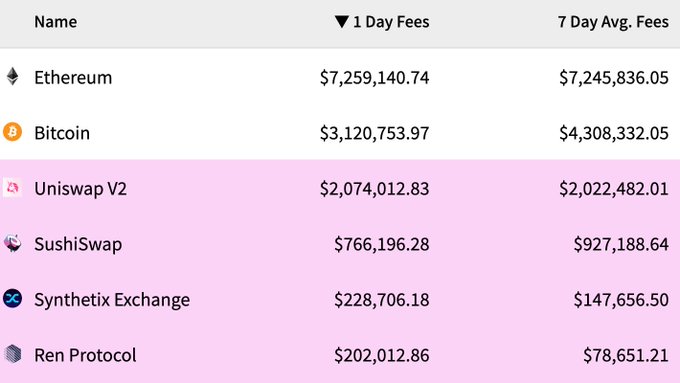

More participants have been joining the Ethereum bandwagon, and the recent price rally past the record-high of $1,400 cements this fact. Therefore, ETH is stamping its authority in the crypto space because its daily fees paid rose to $7.25 million compared to Bitcoin’s $3.12 million.

An investor at Variant Fund tweeting under the pseudonym Spencer Noon, explained:

“Ethereum continues to dwarf the entire crypto space in terms of fees paid ($7.25m daily avg) -- proving it's the most useful network in the world.”

The top two cryptocurrencies, Bitcoin and Ethereum, are involved in a neck and neck battle as they continue wooing more investors. Time will tell what they have in store going forward as record-breaking moves continue being the order of the day.

Image source: Shutterstock

.jpg)