Ethereum Network Continues to Expand as Non-Zero Addresses Hit ATH

Ethereum has been experiencing notable expansion in its networks as new addresses continue scaling heights.

Ethereum (ETH) has been experiencing notable expansion in its networks as new addresses continue scaling heights.

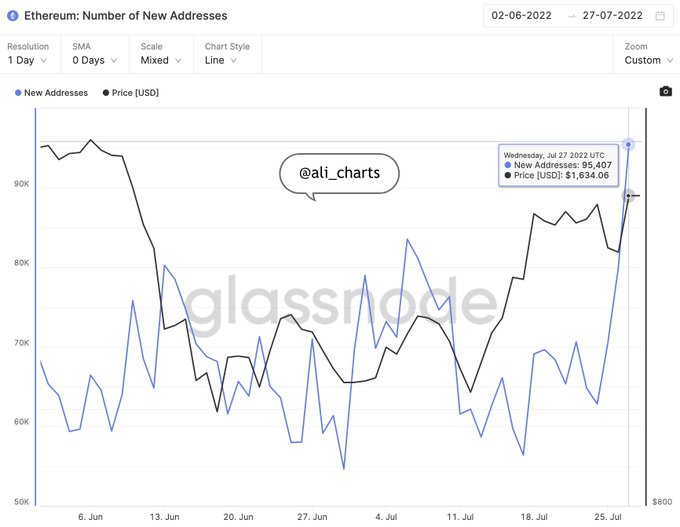

Market analyst Ali Martinez pointed out:

“The Ethereum network is expanding as the number of new addresses continues trending up. Network growth is often considered one of the most accurate price predictors. Generally, a steady increase in the number of new addresses created on a given blockchain leads to a major price upswing.”

Source: Glassnode

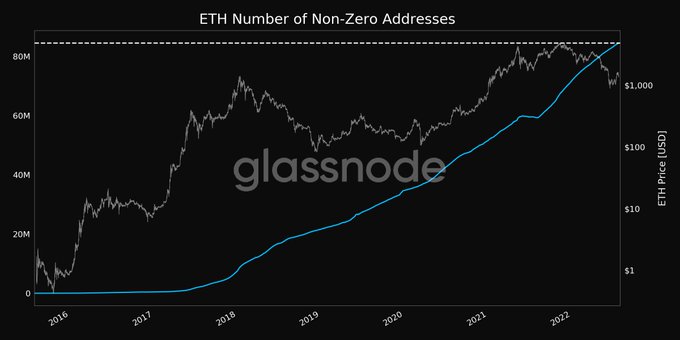

According to on-chain insight provider Glassnode, the number of non-zero ETH addresses reached an all-time high (ATH) of 84,502,086.

Source: Glassnode

This suggests that more participants are joining the Ethereum network amid daily active addresses hitting historical highs.

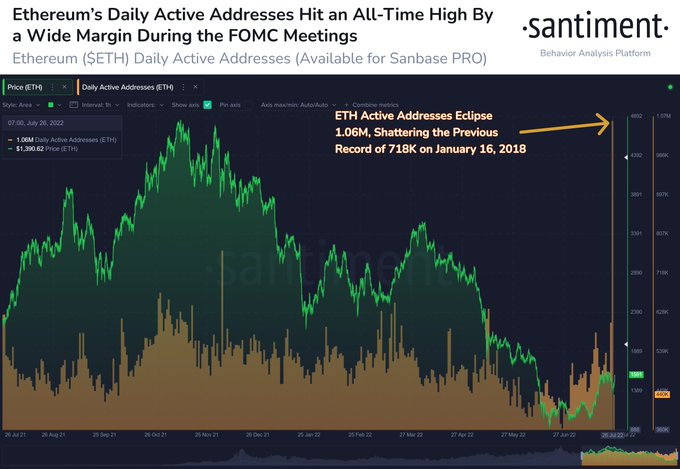

Market insight provider Santiment pointed out:

“Ethereum shattered records Tuesday after an incredible surge in address activity broke its AllTimeHigh by a wide margin. 1.06M ETH addresses made transactions, & the team is still investigating the cause of the +48% increase over the previous record.”

Source: Santiment

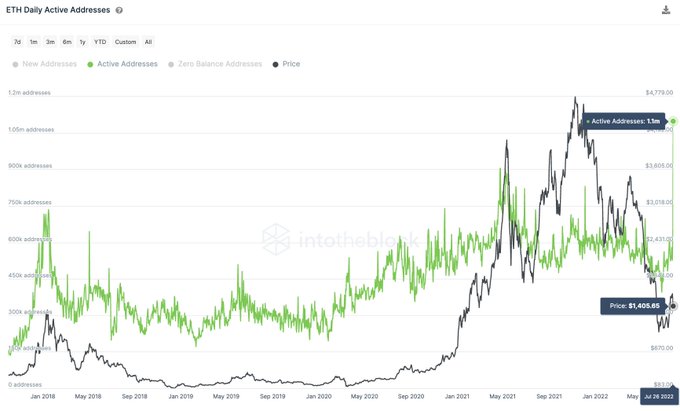

Data analytic firm IntoTheBlock echoed similar sentiments and stated:

“Ethereum daily active addresses reached a new all-time high. Over 1.1M addresses made an ETH transaction yesterday, making a total of 1.64M transactions.”

Source: IntoTheBlock

Therefore, the surge in daily active and new addresses might have boosted Ethereum’s present upward momentum.

The second-largest cryptocurrency was up by 10.68% in the last 24 hours to hit $1,625 during intraday trading, according to CoinMarketCap.

Interestingly, this is happening amid the Federal Reserve (Fed) hiking the interest rate by 75 basis points (bps) to tame rising inflation without creating a recession. Analysis history showed that the increase in interest rate is usually followed by a bearish impact on the crypto market.

Image source: Shutterstock

.jpg)