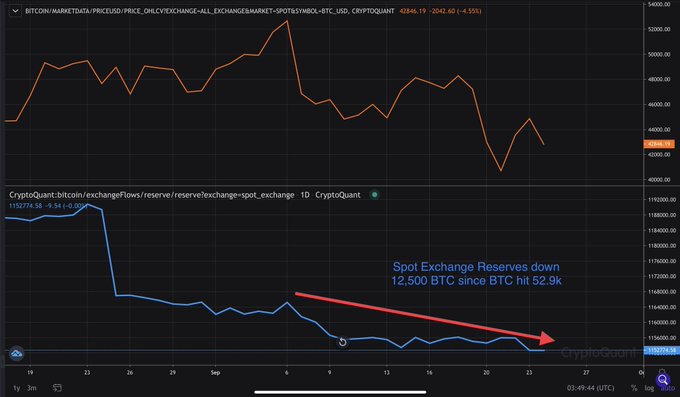

Bitcoin Spot Exchange Reserves Dropped by 12,500 BTC in the Past 2 Weeks, Suggesting the Dip is Being Bought

Bitcoin Spot Exchange Reserves were down by 12,500 BTC in the past 2 weeks as price fell by 25%.

Bitcoin (BTC) was up by 5.9% in the last 24 hours to hit $43,885 during intraday trading, according to CoinMarketCap.

Earlier this month, BTC experienced a significant pullback that prompted a $10K loss as over-leverage factors dominated. The leading cryptocurrency dropped from the $52,000 level to the $42K area. As a result, the BTC spot exchange reserves plummeted.

On-chain analyst Daniel Joe explained:

“Bitcoin Spot Exchange Reserves are down by 12,500 BTC in the past 2 weeks as price fell by 25%. The dip is being bought.”

Therefore, some investors and traders see the current market structure as a perfect dip to buy.

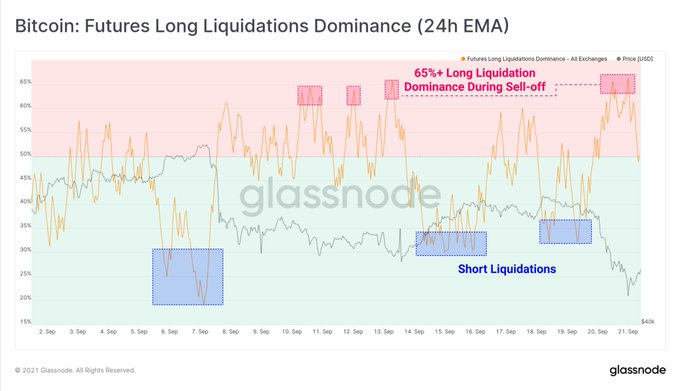

On the other hand, the recent market crash made BTC long liquidation dominance surge past 65%. Yann & Jan, the co-founders of on-chain metric provider Glassnode, noted:

“Bitcoin long liquidation dominance rose above 65% during the recent sell-off. This is even higher than the sell-off earlier this month suggesting many leveraged traders tried to catch the falling knife.”

Holded or lost BTC hit an eight-month high

According to Glassnode:

“The amount of HODLed or lost coins just reached an 8-month high of 7,197,405.196 BTC.”

This correlates with the fact that Bitcoin accumulation has been witnessing an uptrend. Furthermore, long-term BTC holders or older hands have not been spending their coins, given that the average age of spent outputs was decreasing irrespective of the market situation.

Glassnode recently acknowledged that a large portion of Bitcoin supply was kept in cold storage. Therefore, more Bitcoin supply being kept in cold storage signifies a holding culture. This is bullish because investments are held for future purposes other than speculation.

Meanwhile, Bitcoin transaction volumes have been reflecting the trickling in of big money.

Institutional investments played an instrumental role in Bitcoin’s journey towards record high prices. For instance, big-money moves enabled the leading cryptocurrency to hit an all-time high (ATH) price of $64.8K in mid-April.

Image source: Shutterstock

.jpg)