Bitcoin Hits a 16-Month Low of $26K as Effects of the Terra Crash Spill Over

Bitcoin nosedived to lows of $26,595, a scenario not seen since Dec 30, 2020, when the leading cryptocurrency dropped below the $27,000 zone.

Bitcoin (BTC) nosedived to lows of $26,595, a scenario not seen since Dec 30, 2020, when the leading cryptocurrency dropped below the $27,000 zone.

Even though Bitcoin had regained momentum to hit $27,769 during intraday trading, the top crypto continues to limp based on factors like Fed’s interest rate hike and the Terra crash.

TerraUSD (UST) and Luna (LUNA) are two tokens mainly supported by the Terra network, a blockchain project developed by South Korean-based Terra Labs.

LUNA sent shockwaves to the crypto market because it collapsed to nearly zero in just a day.

Source: TradingView

LUNA was previously one of the largest cryptocurrencies based on more than $40 billion in market capitalization. It had shed off 97% of its value in the last 24 hours, according to CoinMarketCap.

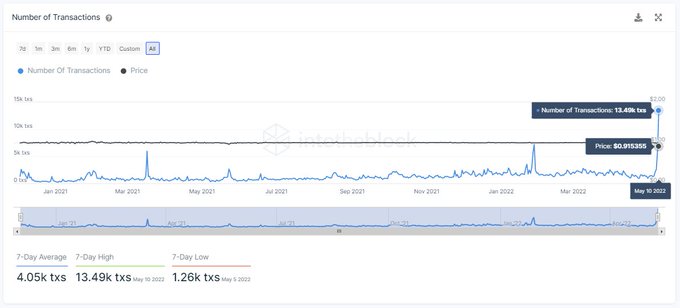

Terra’s UST was also not spared because it fell to lows of $0.225 this week despite it being the third largest stablecoin globally after Tether (USDT) and USD Coin (USDC). Market insight provider IntoTheBlock noted:

“As the stablecoin UST fell to $0.225 overnight, the number of transactions happening reached a new high, representing a 13x increase against the previous 2 days. Investors are rushing to sell their UST positions.”

Source: IntoTheBlock

Despite UST recovering to $0.63 during intraday trading, it is still below the expected $1peg.

Therefore, Bitcoin is still suffering from the receiving end based on the shockwaves triggered by intensified liquidation of UST and LUNA.

Moreover, the leading cryptocurrency faces additional pressure because the Luna Foundation Guard intends to revive UST by selling its BTC reserves worth $3 billion.

Nevertheless, as Bitcoin continues to trade in the extreme fear territory, time will tell how it plays out in the short term because events of intense fear are often followed by bullish momentum.

Image source: Shutterstock

.jpg)