More Than 1,000 Crypto Deals Sealed for Venture Capital Firms, Worth $17bn in 2022

Brian Njuguna Apr 25, 2022 08:25

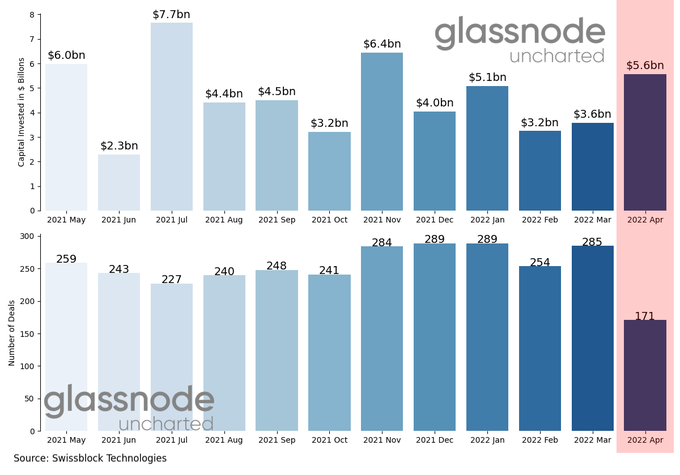

Venture Capital (VC) firms continue penetrating the crypto sector, given that they have pumped in $17 billion so far this year.

Venture Capital (VC) firms continue penetrating the crypto sector, given that they have pumped in $17 billion so far this year.

Glassnode co-founders under the pseudonym Negentropic explained:

“$17bn VC crypto investments and +1k deals in 2022. This year has seen the highest median deal size at $4.5mn. Capital is flowing into BTC and altcoins, setting up for a strong recovery.”

Source: Swissblock Technologies

VC firms have been keeping a keen eye on the crypto sector based on the massive capital inflows witnessed. For instance, they invested a whopping $30 billion in 2021.

Market analyst Holger Zshaepitz pointed out:

“Crypto attracted $30bn of venture-capital funding in 2021, more than in all other years combined. VC money almost quadrupled previous high of $8bn in 2018, the year following Bitcoin’s 1,300% breakthrough gain.”

Bitcoin Whale Accumulation Soars

Despite Bitcoin whales’ holdings dropping significantly since October 2021, their accumulation has gained momentum based on the addition of 18,104 BTC.

Market insight provider Santiment stated:

“Bitcoin whale addresses holding 100 to 10k BTC have collectively accumulated 18,104 more BTC since the April 10th price drop below $40k. However, their holdings are still down substantially since October.”

Holding is a favoured strategy in the Bitcoin market, given that accumulation is not only being undertaken by whales but also by smaller addresses.

Crypto analytic firm IntoTheBlock noted:

“The BTC accumulation is not only a whale’s game. Addresses holding <10 BTC have increased their holdings in 2022 dramatically.”

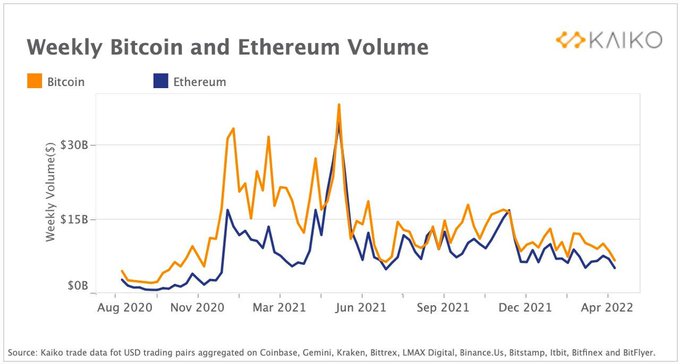

Meanwhile, the weekly trade volume on centralized exchanges hit lows, last seen in June 2021.

Source: Kaiko

The tendency also shows a holding culture because once coins exit exchanges, they are transferred to cold storage and digital wallets for future purposes other than speculation.

Image source: Shutterstock

.jpg)