Bitcoin Shark, Whale Addresses Have Been Surging Since Mid-June

Brian Njuguna Aug 05, 2022 09:35

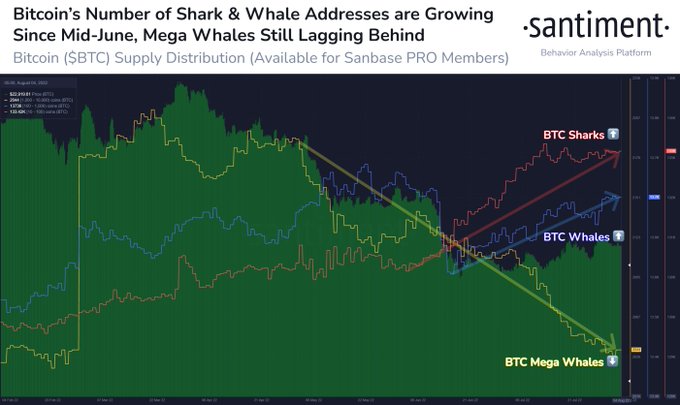

As Bitcoin continues hovering around the $23,000 level, shark and whale addresses have been experiencing a leg up since mid-June.

As Bitcoin (BTC) continues hovering around the $23,000 level, shark and whale addresses have been experiencing a leg up since mid-June.

Crypto insight provider Santiment explained:

“As Bitcoin hovers right around $23k here in the first week of August, we see a continued trend of growing numbers of addresses popping up that hold between 10 to 1,000 BTC. In the past 2 months, 2,428 new addresses of this size have returned.”

Source:Santiment

This illustrates that notable players in the Bitcoin ecosystem have been accumulating more coins, which is a bullish sign.

Meanwhile, market analyst Ali Martinez believes that BTC still sits on significant support. He pointed out:

“Data shows Bitcoin sits on top of stable support between $17K and $23K, where 3.4 million addresses bought 2.13 million BTC. On the flip side, the most important resistance level is between $31K and $41K, where 5.37 million addresses had previously purchased 2.55 million.”

The leading cryptocurrency was hovering around $23,129 during intraday trading, according to CoinMarketCap.

Nevertheless, Bitcoin is not out of the woods yet because it still needs to attract significant buying demand to experience a major leg up. Crypto trader Rekt Capital stated:

“BTC is still trying to retest the 200-week MA as support However, there is very little buy-side volume coming to support the retest at this time In fact, volume has been seller-dominated all week thus far.”

Source:TradingView/RektCapital

Market insight provider Glassnode recently shared similar sentiments that new demand was needed in the BTC market. Glassnode explained:

“With exception of a few activity spikes higher during major capitulation events, the current network activity suggests that there remains little influx of new demand as yet.”

Meanwhile, BTC balances on exchanges have been experiencing a macro decline, showing a hodling culture.

Image source: Shutterstock

.jpg)