Bitcoin Hit Lows of $42K, following the Liquidation of $2.2B in 12 Hours

Brian Njuguna Dec 06, 2021 03:45

Over the weekend, Bitcoin (BTC) plunged to lows of $42,000 based on massive liquidations. Variant Omicron strain and overleveraged market were attributed to this round of chain liquidations.

Over the weekend, Bitcoin (BTC) plunged to lows of $42,000, a move that stunned the crypto space.

Market analyst Holger Zschaepitz noted:

“Bitcoin plunges >20% in another sign of global market nerves. The largest digital token fell as low as $42,296 before paring some of the tumble.”

The Bitcoin market suffered massive liquidations to the tune of $2.2 billion in a span of twelve hours as open interest dropped by 25%, according to Lex Moskovski- the CIO of Moskovski Capital.

Moskovski added that the uncertainty triggered by the variant Omicron strain and overleveraged market triggered chain liquidations.

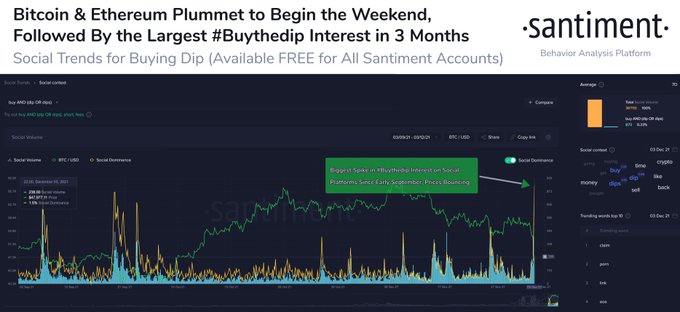

On the other hand, this price drop triggered the largest buy the dip interest in 3 months, according to crypto insight provider Santiment.

Meanwhile, investors holding less than 1 BTC own 5.1% of the Bitcoin supply. In August, the supply kept by long-term BTC holders stood at 66%.

Holding continues to be a favoured strategy in the crypto space, given that BTC investments are meant for future purposes other than speculation. As a result, coins are kept in cold storage and digital wallets away from crypto exchanges.

Holding is based on the law of economics pertaining to demand and supply because it often creates a supply deficit in the market. Therefore, lower supply and higher demand usually trigger a price increase.

Nevertheless, the battle between long-term and short-term holders has also played a part in their contrary positions in the BTC market. For instance, as long-term BTC holders kept on accumulating, their short-term counterparts continued selling, resulting in a stalemate.

Meanwhile, seller exhaustion is showing similar traits to those of July and October bottoms.

“Bitcoin seller exhaustion is seeing a similar divergence to the last two bottoms in July and October: •Seller Exhaustion bottoming •Seller Exhaustion rising while Bitcoin price trends down •Bitcoin price begins rising,” according to market analyst Matthew Hyland .

Image source: Shutterstock

.jpg)