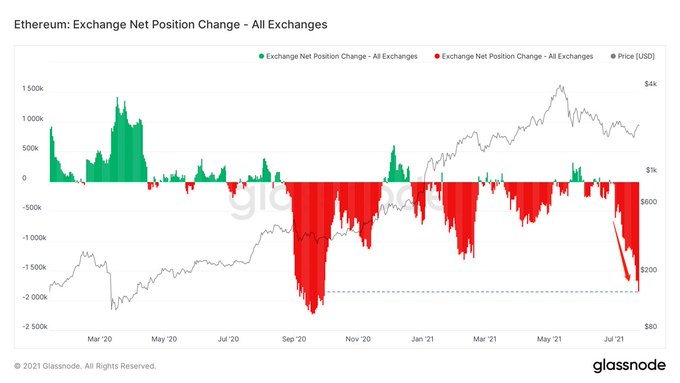

Ethereum Outflows from Exchanges Continue Increasing Amid a Roaming Supply Squeeze

A holding tendency continues to be illustrated in the Ethereum network based on ETH outflows from crypto exchanges.

A holding tendency continues to be illustrated in the Ethereum network based on ETH outflows from crypto exchanges.

Journalist Colin Wu explained:

“According to glassnode, all exchanges continue to have negative net positions in Ethereum, and outflows of ETH continue to increase. The net outflows on July 24 reached the level at the end of September last year.”

It, therefore, shows that Ethereum has been leaving exchanges in droves. This is bullish based on market forces that price increases when supply drops and demand rises.

The demand for Ethereum has been on an upward trajectory based on the booming decentralised finance (DeFi) and non-fungible token (NFT) sectors. As a result, ETH has been settling three times more value on-chain than Bitcoin daily.

The neck-to-neck dominance battle between Ethereum and Bitcoin has been playing out. For instance, in late June, ETH’s daily active addresses surpassed Bitcoin for the first time in crypto history. Precisely, Ethereum’s daily active addresses shot up to 649,000, whereas those of Bitcoin stood at 580,000.

A supply squeeze is expected in the ETH network

According to a market analyst tweeting under the pseudonym 0xtendies:

“ETH leaving exchanges hit YTD high. Last time this happened BTC was $10K & ETH was $250. Supply squeeze coming.”

Therefore, supply is expected to diminish, which could prompt an upward momentum.

Meanwhile, Ethereum is expected to undergo a 90% daily emission reduction from 12,800 to 1,280, followed by ETH 2.0 upgrade. As a result, yearly inflation will be down from 4.3% to 0.43%.

Ethereum 2.0, also known as the Beacon Chain, was launched in December 2020 and was regarded as a game-changer that seeks to transit the current proof-of-work (POW) consensus mechanism to a proof-of-stake (POS) framework.

Image source: Shutterstock

.jpg)