Bitcoin’s Illiquid Supply Hits ATH as BTC and the S&P 500 Index Continue Being Strongly Correlated

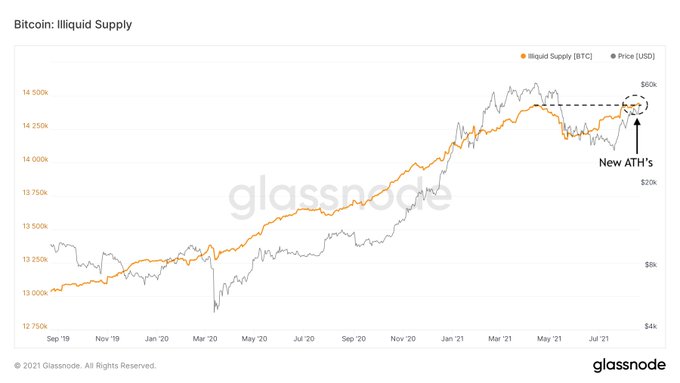

Illiquid supply in the Bitcoin network hit a record-high, as acknowledged by on-chain metrics provider Dilution-proof.

The illiquid supply of the Bitcoin network hit a record-high, as acknowledged by on-chain metrics provider Dilution-proof.

Illiquid supply often indicates a holding or hodling culture because coins are usually kept in cold storage and digital wallets instead of crypto exchanges where they can be easily liquidated.

Hodling is a favoured strategy because Bitcoin is stored for future and long-term purposes other than speculation.

The amount of lost or hodled Bitcoin recently hit a 5-month high of 7,131,084.104 BTC, as revealed by crypto analytic firm Glassnode.

Therefore, this accounts for about 33.96% of the total BTC supply, the highest point in the past five months. These coins can be regarded as out of circulation, which shows the rise in illiquid supply.

Bitcoin and the S&P 500 Index show a significant correlation

According to market insight provider Santiment:

“Over the past month, Bitcoin and the S&P 500 have been correlating quite strongly, and that includes the mild decline over the past couple of days. Meanwhile, the inverse correlation between BTC and gold's price has calmed down significantly.”

The S&P 500 Index, or the Standard & Poor's 500 Index, is a market-capitalization-weighted index of the 500 largest publicly traded companies in the United States.

Historically, a significant correlation between BTC and the S&P 500 Index usually triggers an upsurge in Bitcoin’s price.

Meanwhile, crypto adoption continues to witness an uptick. For instance, Cryptocurrency exchange Coinbase recently stated that it had committed $500 million in cash and cash equivalents, and 10% of its quarterly net income would be invested in a portfolio of crypto assets.

Furthermore, British retail banking giant Lloyds Banking Group announced the hiring of digital cryptocurrency experts because the crypto-asset outlook had considerably evolved as several factors had combined to make them ready for the possibility of broader use.

Image source: Shutterstock

.jpg)