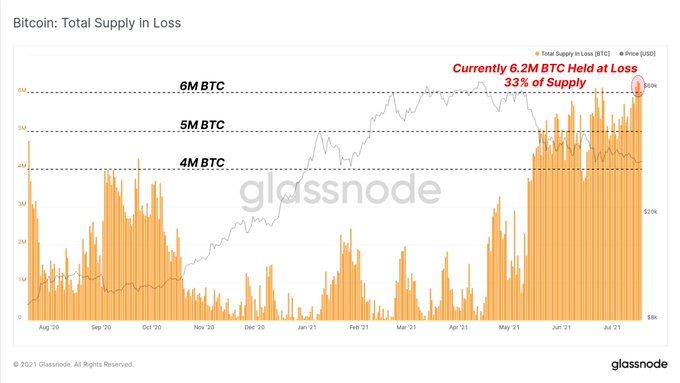

6.2 Million Bitcoins are Being Held at a Loss, Representing 33% of BTC Supply

Ever since Bitcoin (BTC) nosedived from an all-time high (ATH) price of $64.8K recorded in mid-April, 6.2 million coins are being held at a loss, representing 33% of supply.

Ever since Bitcoin (BTC) nosedived from an all-time high (ATH) price of $64.8K recorded in mid-April, 6.2 million coins are being held at a loss, representing 33% of supply.

Market analyst Lark Davis explained:

“According to Glassnode, an incredible 6.2 million Bitcoins are sitting in a position of unrealized losses right now.”

Unrealized loss entails the decline in the value of an asset that has not yet been sold. Therefore, 6.2 million BTC continue being held by investors at a price lower than they were bought.

Low volatility has been one of the primary factors making Bitcoin not go back to its ATH levels as institutional investment has dried up. Furthermore, an intensified crackdown on BTC mining by Chinese authorities has negatively impacted this market.

Nevertheless, a recent Fidelity study showed that 70% of institutional investors were still eyeing the crypto market in the future, which offers hope for the leading cryptocurrency.

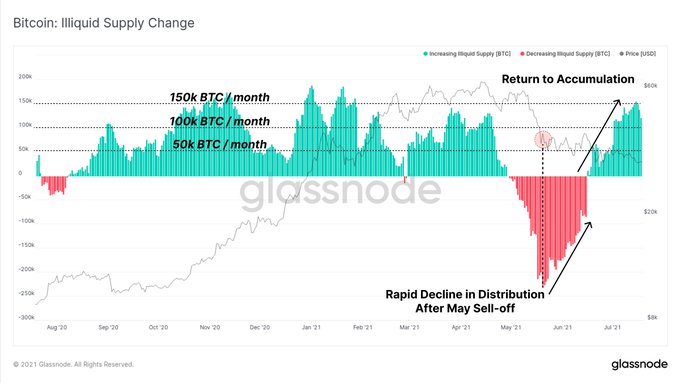

Bitcoin’s illiquid supply change shows more accumulation

Davis also noted that BTC’s illiquid supply change was firmly showing that investors were accumulating.

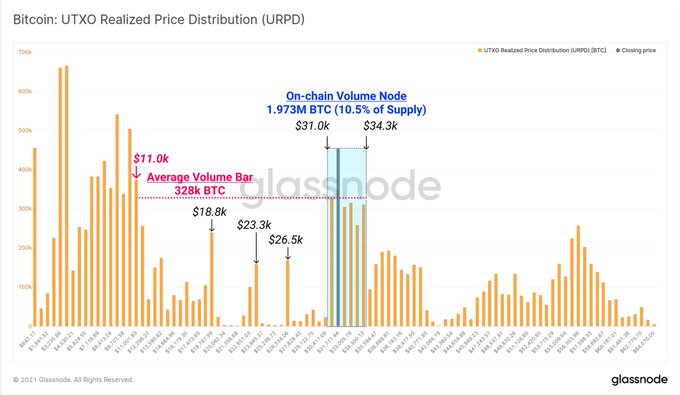

Bitcoin, therefore, is lying at a critical support level because 10.5% of its supply was transacted between $31K and $34K.

If this level is lost, the top cryptocurrency could be sold in a panic, ending with a cascading effect as more panic sellers could create.

Bitcoin collapse?

BTC has dropped below the psychological price of $30K on Tuesday, Jul 20, for the second time since mid-May. The entire crypto market found itself on the receiving end because nearly $98 billion was lost.

However, some analysts are convinced that is not surprising. Ulrik K.Lykke, executive director at Crypto/Digital Assets Hedge Fund ARK36, said:

"A drop below the $30K level isn't surprising or overly concerning as BTC has traded in the $30-34K level for more than 8 weeks now, struggling to gain support above that barrier. In such market conditions, some investors may grow a little restless, especially that Bitcoin and the general digital asset markets are facing increased regulatory scrutiny.

Yet, Bitcoin had regained some momentum in the last 24 hours when it was up by 3.36% and rebounded above $30,816 during intraday trading, according to CoinMarketCap.

Ruud Feltkamp, CEO of automated trading bot platform Cryptohopper, said it would be interesting to see if the rebound can support and keep its strength. If it tests the support again, " it would probably not see such a bounce and face a sell-off to $23K."

"As expected, Bitcoin bounced back up after falling below $30k. The support at $30k is so strong that going below this now almost magic threshold would almost always respond in a bounce."

Image source: Shutterstock

.jpg)