16.4% of Total Bitcoin Supply Back to Profitability as Daily BTC Addresses Edge Closer to the 1M Mark

16.4% of total BTC supply is back to profits, which indicates that approximately 3.08M BTC were last spent, and thus have an on-chain costs basis in this price range.

Bitcoin (BTC) seems not to be relenting in its quest to scale the heights, given that its upward momentum is still life days after breaching the psychological price of $40K. The top cryptocurrency was up by 2.15% in the last 24 hours to hit $46,159 during intraday trading, according to CoinMarketCap.

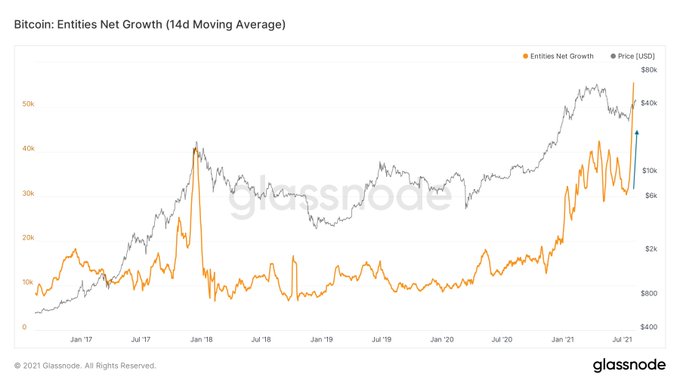

As 16.4% of the total BTC supply is back to profits, Crypto analytic firm Glassnode explained:

“Between the low of $29.7K, and the current price at $45.4K, a total of 16.4% of total Bitcoin supply returned to profit. This indicates that approximately 3.08M BTC were last spent, and thus have an on-chain costs basis in this price range.”

Furthermore, the latest surge has given short-term Bitcoin holders a reason to smile because their investments are back to positive values.

In May, BTC became the talk of the town after it nosedived from an all-time high (ATH) of $64.8K recorded in mid-April to lows of $30K. Nevertheless, the leading cryptocurrency is regaining lost grounds.

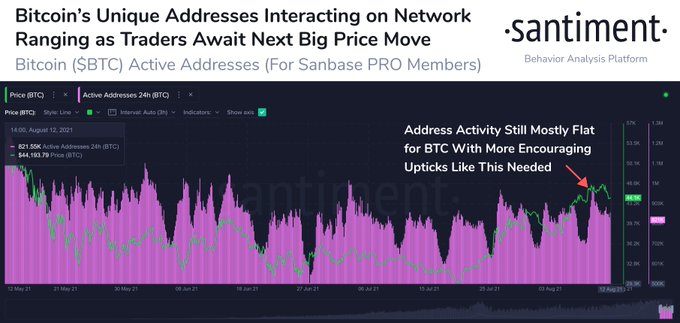

Bitcoin daily addresses eye the 1 million level

According to on-chain metrics provider Santiment:

“Address activity continues to be a very important metric to watch for hints on whether Bitcoin will cross $50K or fall below $40K. Currently 720K to 930K addresses use the BTC network daily, and we're looking for a spike above 1m as a bull run signal.”

Therefore, a notable number of participants has been using the Bitcoin network., as acknowledged by on-chain analyst Lex Moskovski.

Significant on-chain resistance stands between $45.6K and $46.9K

IntoTheBlock believes that Bitcoin should shutter on-chain resistance between the $45.6K and $46.9K before getting the green light and heading towards the $50K level. The data analytic firm explained:

“As demonstrated by the high amount of trading activity, the biggest level of on-chain resistance for BTC in order to reach $50k is located between $45.6k and $46.9k, where 763k addresses bought 428k BTC.”

With an uptick in daily Bitcoin activity being recorded, whether this will trigger a surge to the psychological price of $50,000 remains to be seen.

Image source: Shutterstock

.jpg)