IRS

IRS Delays Crypto Reporting Requirements for US Businesses

The IRS delays enforcing crypto transaction reporting requirements for US businesses, pending a comprehensive regulatory framework. This follows the crypto community's concerns over the practical challenges of complying with the Infrastructure Investment and Jobs Act's rules.

Binance Enhances Trading Options with New Pairs and Bot Services

Binance boosts its trading services with new spot trading pairs and trading bot services, expanding options and enhancing user experience. This includes pairs like MOVR/TRY, LDO/FDUSD, and more, with a focus on FDUSD and Turkish Lira pairs.

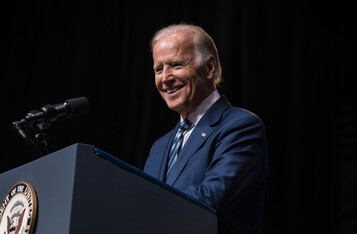

DeSantis Proposes Flat Tax and IRS Elimination, Sparks Trump Rivalry in 2024 Race

In the 2024 presidential campaign, Florida Governor Ron DeSantis advocates for a flat tax system and the elimination of the IRS, a move that has ignited a political battle with Donald Trump, highlighting internal Republican party dynamics and differing tax policy visions

How the 2021 Infrastructure Bill Impacts Cryptocurrency Reporting and Tax

The 2021 Infrastructure Bill requires IRS reporting for crypto transactions over $10,000, expanding cash definition to digital assets, and requiring brokers to report customer details within 15 days.

IRS's $24 Billion Tax Claim Threatens Recovery for FTX Victims

The IRS's $24 billion tax bill against bankrupt FTX complicates recovery for victims, as FTX challenges the claim, claiming lack of basis and threats to compensation funds.

Block's AUD$3M Investment Boosts Indigenous Business Sector in Australia

Block Inc. invests AUD$3 million in First Australians Capital's new fund, supporting Indigenous businesses in Australia, aiming to empower entrepreneurs, foster economic growth, and create community wealth.

Court Upholds OFAC's Designation of Tornado Cash Under IEEPA

The US District Court upheld the OFAC's designation of Tornado Cash under the IEEPA, rejecting plaintiffs' claims of overreach and First Amendment violations, highlighting legal challenges for privacy-oriented blockchain entities.

U.S. Senators Urge Treasury and IRS for Swift Cryptocurrency Tax Rule Implementation

A group of U.S. Senators has expressed concern over a two-year delay in implementing tax reporting requirements for crypto brokers, urging the Treasury Department and IRS to expedite the process to close the crypto tax gap, provide clarity for taxpayers, and secure billions in lost tax revenue. The delay contradicts the directives of the Infrastructure Investment and Jobs Act and gives leeway to crypto lobbyists opposing the rule.

GFT and Thought Machine Partner to Drive Digital Transformation in U.S. Banking

GFT and Thought Machine are collaborating to propel U.S. banks into the digital age, departing from legacy systems in favor of cloud-native solutions. Traditional banks are now focusing on introducing innovative financial experiences to gain a competitive edge. The partnership offers three paths to digital transformation, with GFT being a leading implementation partner of Thought Machine's Vault Core. This technology enables the launch of digital-first banks or migration from legacy systems. The partnership has achieved significant milestones, including certifications and completed projects. Traditional banks are poised to leverage their expertise and regulatory frameworks by embracing digitization.

Citi Joins BondbloX Bond Exchange as First Digital Custodian

Citi Securities Services has become the first digital custodian participant on the BondbloX Bond Exchange (BBX), the world's first fractional bond exchange. The partnership allows Citi clients to become BBX participants, facilitating the trading of both fractionalized and full-sized bonds. Citi will oversee settlement and custody services. The partnership aims to enhance digital financial market infrastructure, provide transparency, electronic operations, and universal accessibility in the bond market.