How the 2021 Infrastructure Bill Impacts Cryptocurrency Reporting and Tax

The 2021 Infrastructure Bill requires IRS reporting for crypto transactions over $10,000, expanding cash definition to digital assets, and requiring brokers to report customer details within 15 days.

Significant modifications to the reporting requirements for cryptocurrency transactions have been implemented as a result of the 2021 Infrastructure Bill, which was signed into law by President Joe Biden. These modifications have a specific impact on bitcoin exchanges and custodians. This piece of legislation is a component of a larger initiative to close the tax deficit in the United States, with a particular focus on the quickly development of the digital asset market.

Source: Twitter

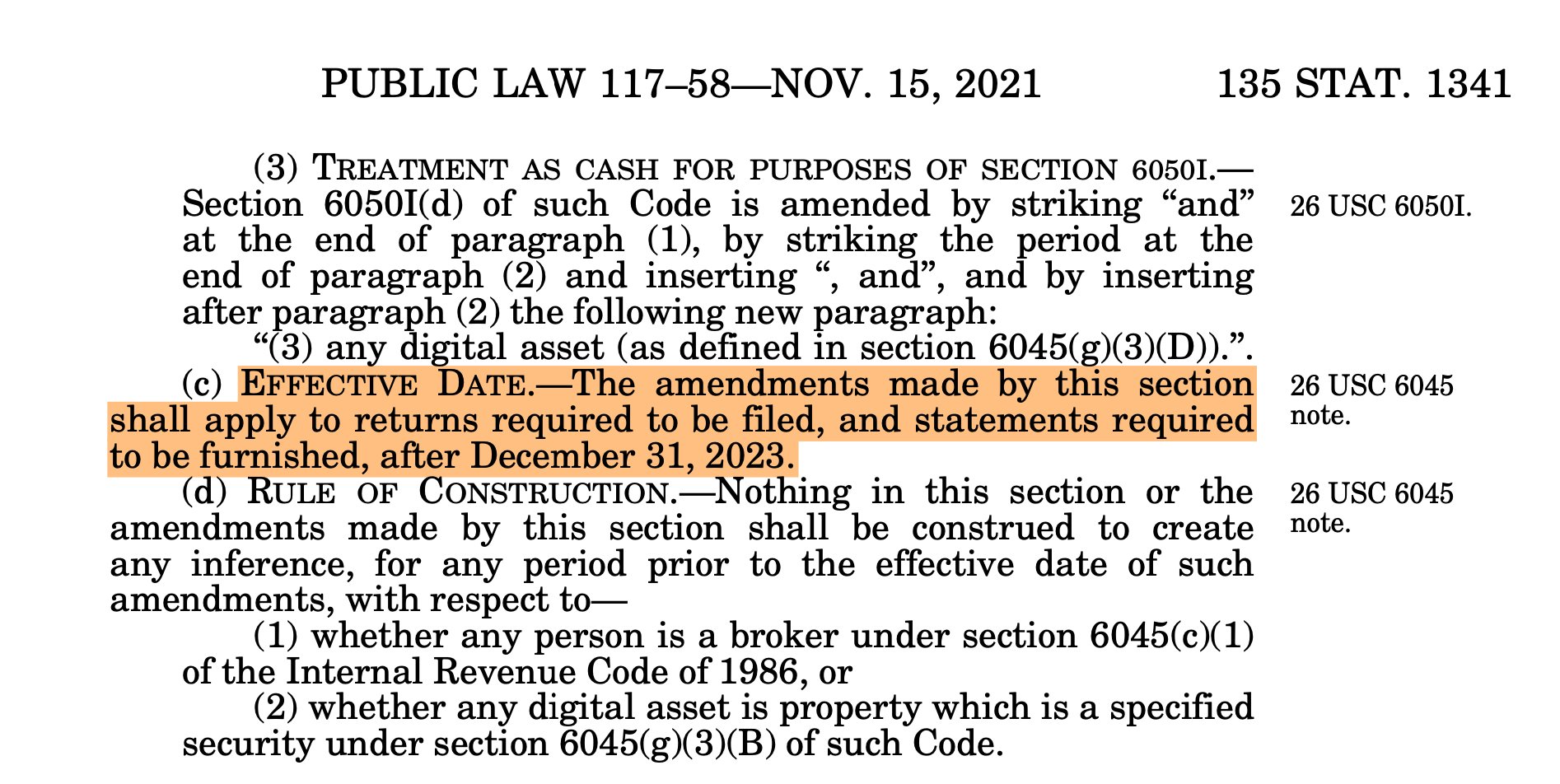

One of the most important provisions of the law is the modification of Section 6050I, which extends the definition of "cash" to include digital assets. As a consequence of this, commencing in the year 2024, every person or company that gets more than $10,000 in digital assets as a result of their commercial or business activity will be required to submit Form 8300 reports to the Internal Revenue Service (IRS). The cryptocurrency industry has long been defined by its decentralized and sometimes opaque nature; this move tries to provide greater openness and supervision to the sector, which has been characterized by these characteristics.

One of the most important aspects of this piece of legislation is the mandate that requires full reporting of transactions involving digital assets that exceed $10,000. A considerable obligation is placed on cryptocurrency brokers as a result of this provision, which originates directly from the infrastructure law that was passed by both parties. They are now obligated to provide the Internal Revenue Service with detailed information on transactions of this kind. This comprises the personal information of consumers who are engaged in transactions that are more than $10,000, such as their names, addresses, and social security numbers. This information is required to be disclosed within fifteen days after the transaction.

It is clear that the government is placing a greater emphasis on the cryptocurrency market, as seen by the proposed rules that were released by the Biden administration about the implementation of this essential revenue-raising component of the 2021 infrastructure bill. The purpose of these laws is to improve compliance and decrease tax evasion within this rapidly expanding industry by mandating extra reporting for transactions using cryptocurrencies.

When seen from a more holistic viewpoint, these modifications represent a fundamental shift in the manner in which the government of the United States views the regulation of digital assets. An awareness of the growing incorporation of cryptocurrencies into conventional financial institutions is reflected in the law, which provides for the extension of regular currency transaction reporting requirements to cover digital assets. Nevertheless, these newly implemented reporting standards have not been without their share of arguments. Those who are opposed to them claim that they might place an excessive burden on cryptocurrency firms and could possibly hinder innovation within the industry. Despite this, some who support the measure believe that it is an essential step that must be taken in order to guarantee more accountability and transparency in the rapidly expanding market for digital assets.

Image source: Shutterstock

.jpg)