Search Results for "svb"

Circle's USDC Reserve Exposure and Potential Risks

Circle's latest audit report reveals that the company's exposure to the US banking system stands at nearly $9 billion, with its reserves held by a number of regulated financial institutions, including SVB, BNY Mellon, and Silvergate. However, recent events such as the shutdown of SVB and Silvergate's decision to shut down its crypto bank arm have raised concerns about potential risks for Circle and its stablecoin USDC.

Circle's USDC Reserves Remain Stuck at SVB, Raises Concerns Over Crypto Stability

Circle's $3.3 billion worth of USDC reserves held at Silicon Valley Bank (SVB) have not been processed, raising concerns over the stability of the cryptocurrency. This follows the disclosure that 20% of Circle's USDC reserves were held in several financial institutions, including the recently bankrupted Silvergate and the now-shuttered SVB. The world of cryptocurrencies has been characterized by volatility, leading to concerns over their stability and reliability as a store of value. One cryptocurrency that has been touted as a more stable alternative to Bitcoin is USD Coin (USDC), a stablecoin that is pegged to the US dollar.

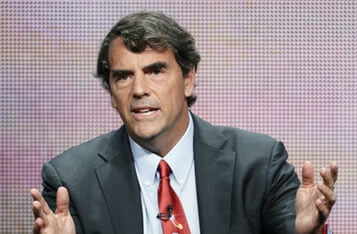

"Tim Draper's Bitcoin Diversification Advice"

Venture capitalist Tim Draper advises business founders to diversify their cash holdings by keeping at least two payrolls worth of cash in Bitcoin or alternative cryptocurrencies, along with other recommendations, in response to the uncertainty created by the collapse of Silicon Valley Bank.

Circle's USDC Reserve Exposure and Potential Risks

Circle's latest audit report reveals that the company's exposure to the US banking system stands at nearly $9 billion, with its reserves held by a number of regulated financial institutions, including SVB, BNY Mellon, and Silvergate. However, recent events such as the shutdown of SVB and Silvergate's decision to shut down its crypto bank arm have raised concerns about potential risks for Circle and its stablecoin USDC.

Binance converts remaining $1 billion in Industry Recovery Initiative to native crypto amidst concerns around stablecoins

Binance co-founder and CEO, Changpeng Zhao, announced on March 13 that the exchange will be converting the remaining $1 billion funds in its Industry Recovery Initiative to native crypto amid concerns surrounding stablecoins. This decision was made following the depegging of the USD Coin (USDC) stablecoin caused by the failure of three major crypto-friendly banks - Silicon Valley Bank (SVB), Silvergate Bank, and Signature Bank.

FinFabrik and Lumiere Co-create the First Securitized Film with ‘Papicha’

FinFabrik and Lumiere, two companies based in Hong Kong made history by performing the first tokenisation of a direct investment into a movie in the world.