US CFTC Commissioner Says Crypto Derivative Contracts Had an Enormous Positive Impact on the US Economy

Sarah Tran Nov 19, 2019 07:00

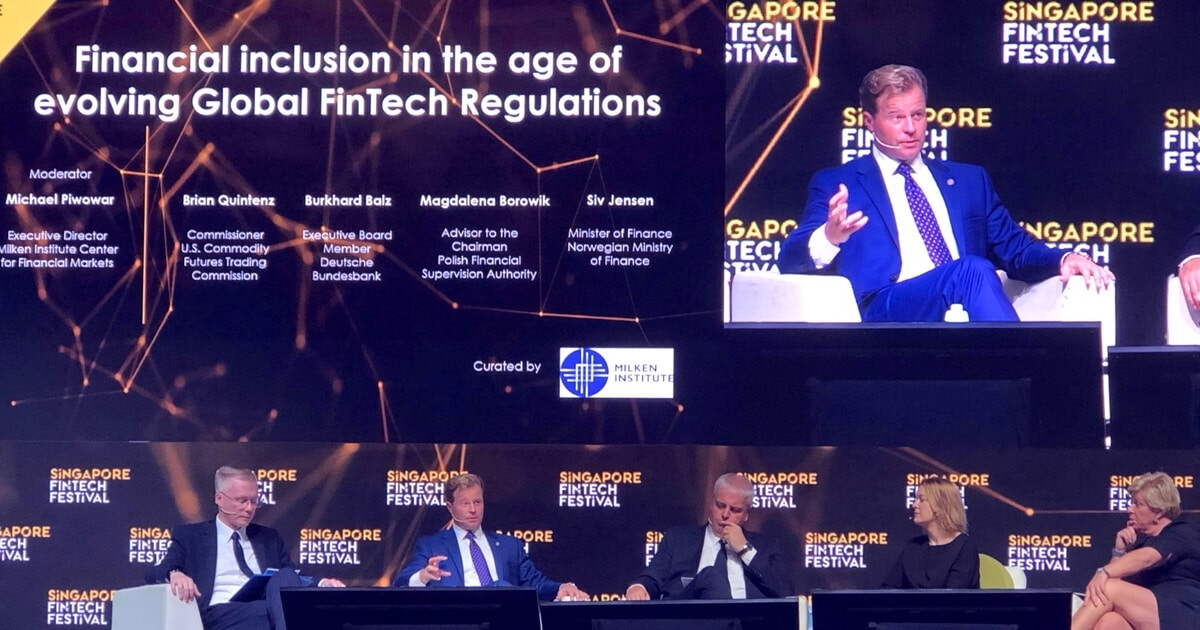

United States Commissioner of the Commodities and Futures Trading Commission (CFTC), Brian Quintenz spoke about the current and future regulation in Fintech at the Singapore Fintech Festival held last week.

United States Commissioner of the Commodities and Futures Trading Commission (CFTC), Brian Quintenz, spoke about the current and future regulation in Fintech at the Singapore Fintech Festival held last week.

Quintenz started by saying that one of the main values that the Commission stands by is to “first do no harm, then be technology-neutral.”

LabCFTC working with technologists, innovators, and the public

As stated by Quintenz, CFTC has been engaging with innovators and technologists, “to understand what they were doing, to help them understand if what they were doing implicated our rules, and to help the CFTC understand if there is any technology we can take advantage of as an agency to enhance our own processes."

LabCFTC, the CFTC’s financial technology research wing, has been very active with over 350 different private meetings held with innovators in the last two years, as Quintenz mentioned. LabCFTC has published three primers to the marketplace based on their understanding of smart contracts, artificial intelligence, and crypto assets. They have also looked into how these three categories are evolving outside of, or challenging the current regulatory dynamic.

Two requests for information, the first on crypto assets and the different proofing constructs that back consensus mechanisms such as proof of stake, proof of work, and zero-knowledge proofs were asked from the public. The CFTC was curious to understand the proliferation of derivatives contracts on different assets with different underlying proofing constructs.

Structuring innovation competition and its hurdles with the regulatory sandbox

The second included the request for information on innovation competitions. This helps the CFTC to understand where the lines draw in terms of sandboxes. The regulator is prohibited by law from having a regulatory sandbox due to the legal structure of the US, viewing that there should be free use of technology, which would be an “unauthorized gift” under the US ethics laws, as explained by Quintenz.

“I think it was kind of an unintended consequence of how those rules are written,” commented Quintenz. “There is a discussion right now in Congress to change that, but in the meantime, we’re thinking about how to structure innovation competition because that focuses on our rule set, our processes and if we can bring technologists in-house to compete and solve some of those issues, and to get a better sense as to what the solutions are and how that innovation is evolving.”

Self-certification for a positive impact on the US economy

Quintenz stated: “The provision of derivatives contracts into different parts of the economy has and an enormous positive impact on the US economy to be able to manage that risk and provide stable prices for goods and services, building apps and government involvement and to the private sector.”

The CFTC has led an effort to help exchanges and clearinghouses through the creation of the self-certification process. Exchanges that are looking to list a new contract would not have to go to the CFTC and request approval. Instead, they can list the contract and “self-certify” that meets all the necessary requirements from the CFTC.

The results of implementing self-certification have been quite significant; in the last 15 to 20 years, since self-certification existed, exchanges have listed 8000 new contracts, compared to the 800 contracts listed between 1920 to 2000 prior to self-certification.

.jpg)