New Research Reveals Key Drivers of Crypto Asset Prices

Tony Kim Jul 30, 2024 17:55

A study by Uniswap (UNI) Labs, Circle, and Copenhagen Business School uncovers how traditional financial factors influence crypto prices.

A recent study conducted by researchers from Uniswap (UNI) Labs, Circle Internet Financial, and the Copenhagen Business School has shed light on the impact of traditional financial factors on the price movements of crypto assets, according to Uniswap Protocol.

Key Insights from the Research

The paper delves into how elements such as U.S. monetary policy influence the crypto market. The researchers found that digital assets exhibit behaviors similar to traditional asset classes within the global financial markets. This research is part of Uniswap Labs' ongoing efforts to understand market dynamics and the factors driving crypto prices.

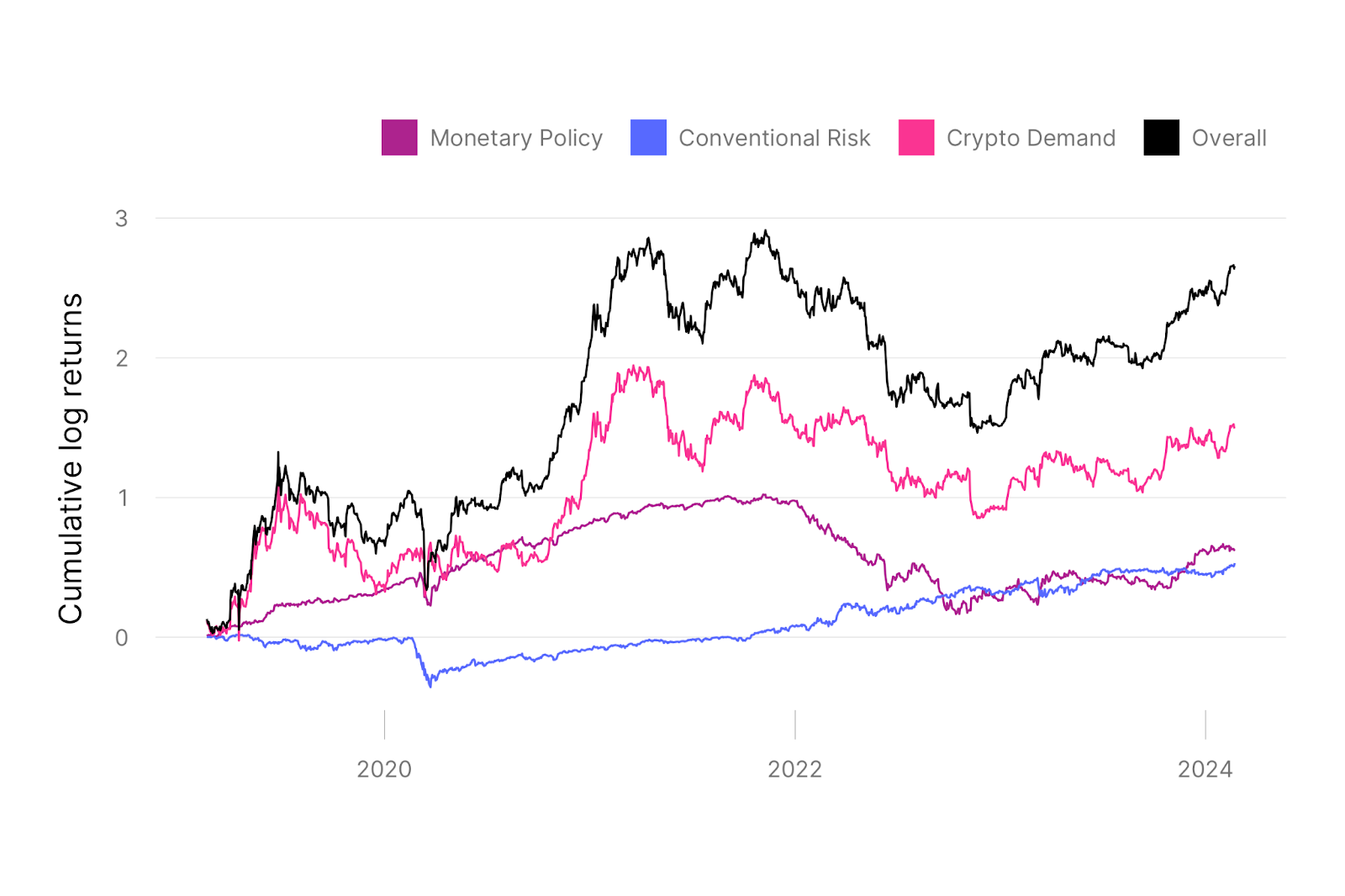

The study breaks down asset prices into three main components: monetary policy, broad market risk premium, and crypto-specific demand. It highlights that contractionary monetary policy was responsible for more than two-thirds of Bitcoin’s (BTC) sharp decline in 2022. Additionally, the research examines significant market events such as the FTX bankruptcy, Bitcoin ETF announcements, and the financial turmoil caused by the COVID-19 pandemic.

Bitcoin's Reaction to Financial Shocks

Notably, the research includes an analysis of Bitcoin's return by shock since early 2019. This analysis provides a deeper understanding of how various financial shocks have impacted Bitcoin prices over the years.

Implications for Crypto Market Perceptions

The findings suggest that crypto prices may be more rational and predictable than previously thought. This could have significant implications for investors and analysts who have traditionally viewed the crypto market as highly volatile and unpredictable.

For those interested in a more comprehensive understanding of the study, the full paper is available on SSRN.

Image source: Shutterstock

.jpg)