Ethereum’s Price Going through the Roof, Subject to Renewed Interest from Short-Term Traders

Ethereum’s surge to historic highs has renewed the discussion of whether the altcoin season is back as short-term traders' interest soars.

Ethereum’s surge to historic highs has renewed the discussion of whether the altcoin season is back.

The second-largest cryptocurrency based on market capitalization scaled the heights by breaching the $4,400 level, a scenario not seen in its six-year journey.

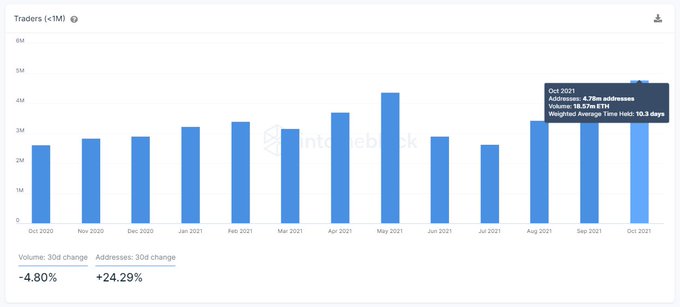

IntoTheBlock believes this upward momentum has been sparked by an increase in the number of short-term traders. The data analytic firm explained:

“The recent highs have been pushed by a renewed interest of short-term traders, as the number of addresses holding ETH for less than 30 days is the highest number in over 12 months.”

This, coupled with diminished supply and high token circulation on the Ethereum network, have been pushing the price upwards.

Furthermore, on-chain metrics provider Santiment recently acknowledged that an increased utility was triggering Ethereum’s bullish momentum. ETH continues to be the most sought-after network in the decentralized finance (DeFi) and non-fungible token (NFT) sectors.

Retail investors are heating the Ethereum market

According to CryptoQuant CEO Ki-Young Ju:

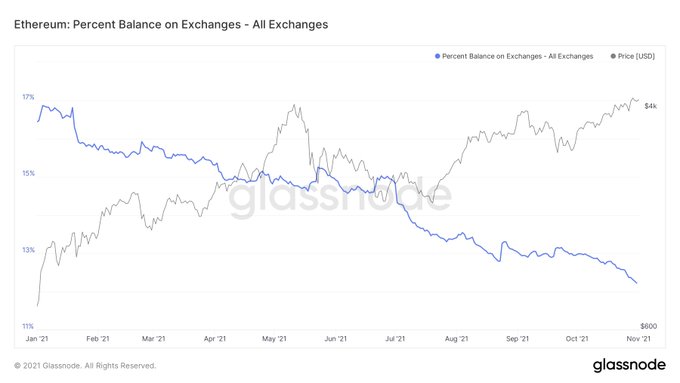

“Retail investors are heating up the crypto market. Looking at on-chain data, the number of ETH withdrawals on centralized exchanges is increasing lately.”

Therefore, ETH has been exiting crypto exchanges in droves, given that the percent balance on exchanges recently dropped to 12.2%.

This is bullish because it signifies a holding culture because coins mostly leave exchanges for digital wallets and cold storage.

Despite the remarkable moves being made by Ethereum, this cryptocurrency is still grappling with high gas fees. Santiment noted:

“Ethereum's gas fees are sitting at approximately $50, which does come with a higher risk of trader reluctance to circulate tokens, as a result. Average gas fees are also spiking mildly.”

Whether the challenge of high gas fees will be solved by a transition to a proof-of-stake (POS) consensus mechanism offered by Ethereum 2.0 remains to be seen.

Image source: Shutterstock

.jpg)