Ethereum Hits Fresh Record High of $3000

Brian Njuguna May 03, 2021 02:15

Ethereum has hit an all-time high of $3000 for the first time in its history, making it more valuable than PayPal and the Bank of America in terms of market cap.

Ethereum’s remarkable bull run continues shedding light on what the second-largest cryptocurrency by market capitalization has to offer. ETH hit an all-time high (ATH) of $3,000.

This uptrend now makes Ethereum more valuable than Paypal, with a market capitalization of $332.63 billion compared to the latter’s $318.33 billion.

Market analyst Lark Davis believes that Ethereum has a lot of potential and will cement its status as a deflationary currency by the end of this year because its value will continue increasing with time. He also expects ETH to be running on a proof-of-stake consensus mechanism during the same time frame.

Ethereum could hit $10,000

According to market analyst Holger Zschaepitz, ETH’s journey to $10,000 looks set. He explained:

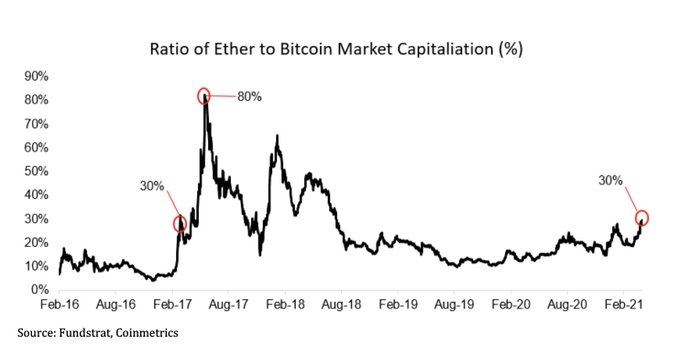

“Ether could hit $10k, FundStrat says, touting network value vs Bitcoin’s. Ethereum’s market cap has risen to ~30% of Bitcoin’s over recent weeks. During the last market cycle, Ethereum broke this level and headed as high as 80% of Bitcoin’s value.”

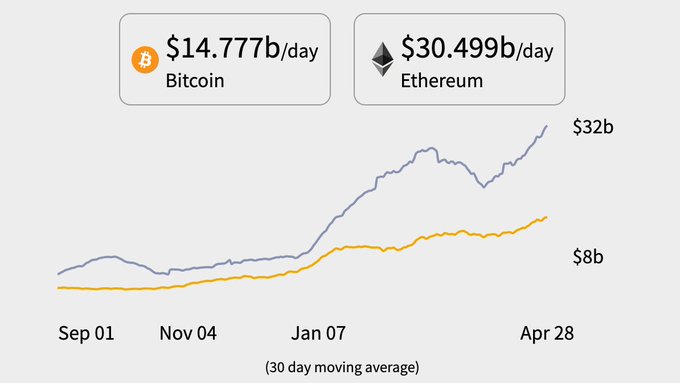

Additionally, Ethereum settles double the transactions that the Bitcoin network handles per day, according to Spencer Noon. The crypto data provider noted:

“Ethereum settles $30.5 billion worth of value per day, far more than Bitcoin and every other blockchain - to put this into context, PayPal settles ~$2.5 billion daily.”

TVL in ETH 2.0 surges past $11 billion

According to on-chain metrics provider Glassnode, the total value in ETH 2.0 deposit contract has rallied to an ATH of $11,534,772,184.

Ethereum 2.0 went live in December 2020, and it seeks to change the current proof-of-work consensus mechanism to a proof-of-stake framework, which is touted to be more environmentally friendly and cost-effective.

The proof-of-stake algorithm allows for the confirmation of blocks to be more energy-efficient and requires validators to stake Ether instead of solving a cryptographic puzzle.

Image source: Shutterstock

.jpg)