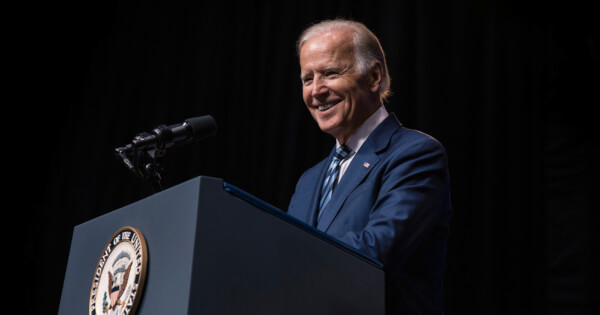

Biden Receives Crypto Regulation Framework from Treasury

Godfrey Benjamin Jul 11, 2022 02:15

The United States Treasury Department has delivered a crypto framework to President Joe Biden as instructed in the Executive Order (EO) issued back in March

The United States Treasury Department has delivered a crypto framework to President Joe Biden as instructed in the Executive Order (EO) issued back in March.

The Treasury Department said the framework sent to the President was created in consultation with the Secretary of State, the Secretary of Commerce, the Administrator of the U.S. Agency for International Development (USAID), and the heads of other relevant agencies.

According to the Treasury, the framework calls on the United States' core allies to collaborate on creating international standards for regulating crypto assets.

Harmonizing Crypto Regulations Across Borders

The Treasury highlights the need to harmonize approaches that can help to nip in the board regulations in combating crimes emanating from the crypto ecosystem which often spills to foreign jurisdictions.

“Uneven regulation, supervision, and compliance across jurisdictions creates opportunities for arbitrage and raises risks to financial stability and the protection of consumers, investors, businesses, and markets,” the framework reads, adding, “Inadequate anti-money laundering and combating the financing of terrorism (AML/CFT) regulation, supervision, and enforcement by other countries challenge the ability of the United States to investigate illicit digital asset transaction flows that frequently jump overseas, as is often the case in ransomware payments and other cybercrime-related money laundering.”

Also, the Treasury wants the US to take the charge in leading talks with respect to the development of Central Bank Digital Currencies (CBDCs) frameworks.

“Such international work should continue to address the full spectrum of issues and challenges raised by digital assets, including financial stability; consumer and investor protection, and business risks; and money laundering, terrorist financing, proliferation financing, sanctions evasion, and other illicit activities,” the Treasury noted.

While the United States is now doing all it can to focus on the nascent crypto industry, the European Union is already ahead. The EU agreed on its own comprehensive framework for Markets in Crypto Assets (MiCA) in the past week, with full implementation barely a few years away.

It is not immediately clear how the US and EU will harmonize strategies moving forward but on CBDCs, more work is still ahead and the collaboration may be more meaningful this way.

Image source: Shutterstock.jpg)