DEEPSEEK

Ensuro Leverages USDC to Enhance Insurance Accessibility for Underserved Populations

Ensuro, using USDC, is revolutionizing insurance by making it more inclusive and capital efficient, especially for underserved populations.

DeFi Insurance Claims Reach $34.4 Million

DeFi insurance firms paid out $34.4 million in claims in 2022, including $22.5 million for the collapse of Terra Luna and $4.7 million for FTX. DeFi insurance now covers eight major categories, but more work is needed to scale.

UAE Gets First Blockchain-Powered Solution to Acceletrate Motor Insurance Claims

XA Group has rolled out the first end-to-end and blockchain-based digital solution dubbed Addenda to tackle the decades-old industry challenge of reconciling motor recovery claims.

Zetrix Announces Launch of NFT-based Insurance Product Covinsure

Public blockchain network Zetrix announced the launch of Covinsure, an NFT-based insurance product.

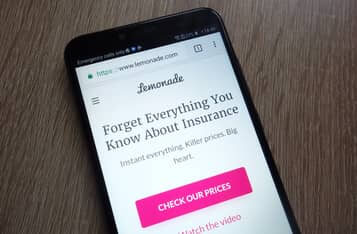

Lemonade to Offer Blockchain-Powered Climate Insurance for Farmers in Emerging Markets

American insurance company Lemonade has revealed the formation of Lemonade Crypto Climate Coalition which will offer blockchain-enabled climate insurance to the most vulnerable farmers across the globe.

Fitch Warns El Salvador’s Bitcoin Adoption Will Hurt Local Insurers’ Credit Ratings

Fitch Ratings has warned El Salvador that its bitcoin adoption plan poses serious risks to local insurance companies.

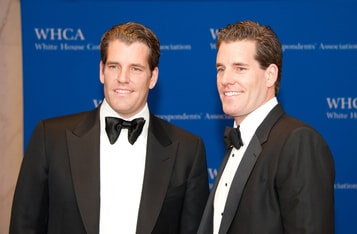

Tyler Winklevoss Predicts $500K BTC price as MassMutual Insurance Giant Buys up $100 million in Bitcoin

MassMutual Insurance buys up $100 million in BTC for its portfolio, and Bitcoin billionaire Tyler Winklevoss appears to be gaining confidence in his $500,000 per BTC prediction.

How Blockchain Technology is Helping to Fight the Novel COVID-19 Pandemic

Coronavirus disease has changed our lives in unprecedented ways. With the imminent lockdown caused by the virus, several reorganizations had to be implemented to keep our lives going. This brief analysis highlights some of the key ways that the application of Blockchain Technology is helping in the fight against the COVID-19 disease and pandemic.

Wyoming State Says Cryptocurrency Represents Property, Allows Insurers to Include Digital Assets in Investment Portfolios

The US. state of Wyoming has enacted new legislation to allow insurance firms to invest in digital assets like cryptocurrencies. The new law intends to come into effect on 1st July.

Insurance Firms in China and Hong Kong Count on Blockchain to Fast Track Coronavirus Claims Amid Outbreak

Xiang Hu Bao, an online mutual aid platform, a subsidiary of Ant Financial, is a “collective claims-sharing mechanism built on blockchain that offers basic health plans to its 104 million participants.” Most of its users are Chinese citizens from lower-tier cities, and in rural areas. By utilizing blockchain technology, settlements have been made more efficient, and fraudulent claims have been reduced.