Ethereum Whales Buy Dip, Increasing Holdings by 180,000 ETH

Brian Njuguna May 12, 2022 23:49

Ethereum whales took advantage of the recent dip by increasing their holdings by 180,000 ETH.

Ethereum whales took advantage of the recent dip by increasing their holdings by 180,000 ETH.

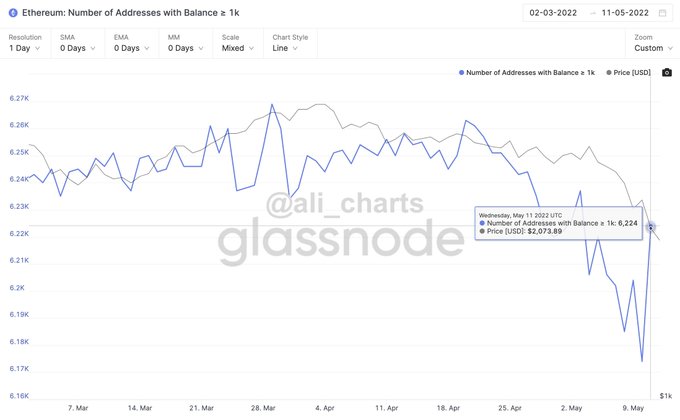

Market analyst Ali Martinez stated:

“Ethereum whales are buying the dip. The number of addresses with a balance greater than 1,000 ETH increased by 0.81%, adding 180,000 ETH to their holdings.”

Source:Glassnode

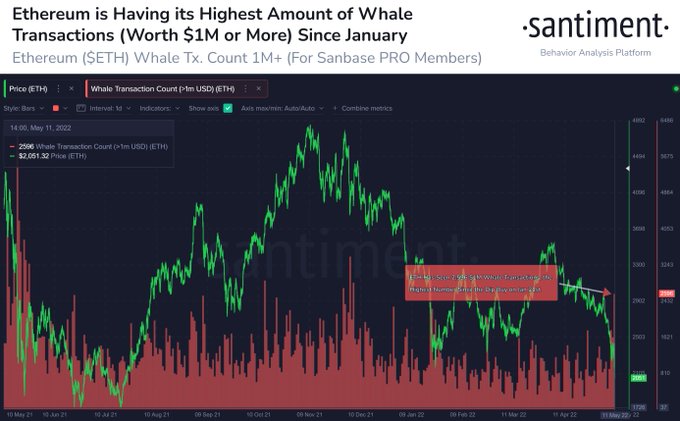

Therefore, whale transactions have been going a notch higher, as acknowledged by Santiment. The on-chain insight provider noted:

“Ethereum's whales have been extremely active, firing off 2,596 transactions valued at $1M or more. This is the highest day of whale transactions since January, and something to monitor if ETH drops below $2k for the first time since last July.”

Source:Santiment

As fear engulfed the crypto market, heightened selling pressure drove Ethereum’s price to lows of $1,800. Data analytic firm IntoTheBlock acknowledged:

“Increasing selling pressure resulted in the price of ETH to hit $1,800. As investors rushed to sell their positions, the Gas has been increasing considerably, reaching 671.24 Gwei.”

Nevertheless, the second-largest cryptocurrency has topped the psychological price of $2,000.

Ethereum was up by 10.03% in the last 24 hours to hit $2,081 during intraday trading, according to CoinMarketCap.

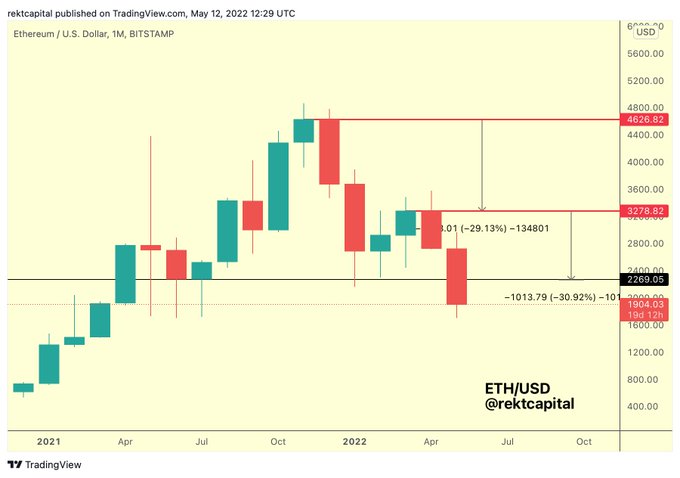

Crypto analyst Rekt Capital believes ETH needs to reclaim the $2,250 level to enhance its bullish run. The analyst stated:

“ETH needs to reclaim black $2250 as support to avoid further downside. If it flips $2250 into new resistance, that would be the second Lower High to form after a -30% retrace from the previous Lower High.”

Source:TradingView

Martinez shared similar sentiments and noted:

“Ethereum is rebounding, but the gains could be capped at $2,200 where 477,000 addresses bought over 3.8 million ETH.”

Meanwhile, the Terra crash might cause a shift to cryptocurrencies that have stood the test of time like Ethereum.

Image source: Shutterstock

.jpg)