The Merge Begins, ETH’s Weekly Social Engagements Increase by 53%

Brian Njuguna Sep 15, 2022 06:30

The much-anticipated Ethereum merge is set to see the light of day begins, ETH’s weekly social engagements increased by 53%.

The much-anticipated Ethereum merge is set to see the light of day is about to begin, according to a Google countdown.

With the crypto community waiting with bated breath to see how this event transpires, given that it’s the biggest software upgrade on the Ethereum network, the second-largest crypto was hovering around $1,603 during intraday trading.

The merge is significant because it will transition the current proof-of-work (PoW) infrastructure to a proof-of-stake (PoS) consensus mechanism, deemed more environmentally friendly and cost-effective.

Social engagements on the Ethereum network have also been going through the roof, with the weekly surge being 53.3%, according to market insight provider LunarCrush.

Furthermore, ETH’s speculative activity has increased. Crypto insight provider Glassnode pointed out:

“Ethereum speculative action continues, with over $6.12B in outstanding Open Interest for Call Options. Put options account for a much smaller $1.5B, making for a Put/Call Ratio of 0.25.”

American multinational investment bank Citigroup or Citi recently pointed out that the Merge would slash the overall Ether issuance by 4.2% annually, making it deflationary, Blockchain.News reported.

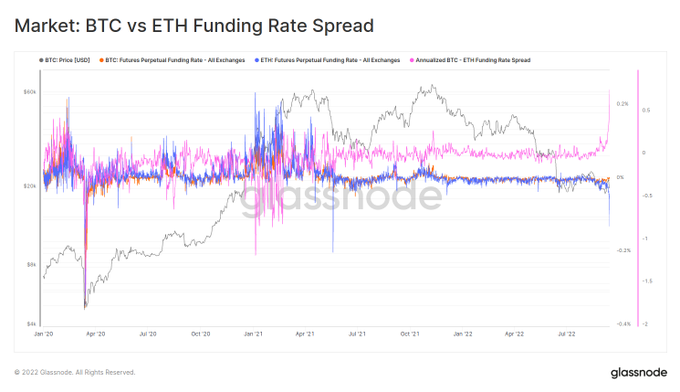

Meanwhile, crypto traders have been significantly shorting Ethereum relative to Bitcoin (BTC) in anticipation of the Merge. Glassnode explained:

“The spread between BTC and ETH perpetual futures funding rates is pushing to a new ATH of 77% annualized. This indicates traders are heavily short ETH relative to BTC, likely speculating/hedging for the upcoming Merge.”

Source: Glassnode

Therefore, time will tell how Ethereum plays out in the post-merge era, with stakes high that it will become a deflationary asset.

Image source: Shutterstock

.jpg)