Crowd Sentiment Towards Bitcoin Tends to be More Positive Than Usual

Crowd sentiment towards BTC has been on an upward trajectory because more traders have become optimistic about this crypto asset scaling the heights.

Bitcoin (BTC) recently breached the psychological level of $40K, a fate which the leading cryptocurrency had tried for months in vain. As a result, crowd sentiment towards BTC has been on an upward trajectory because more traders have become optimistic about this cryptocurrency scaling the heights.

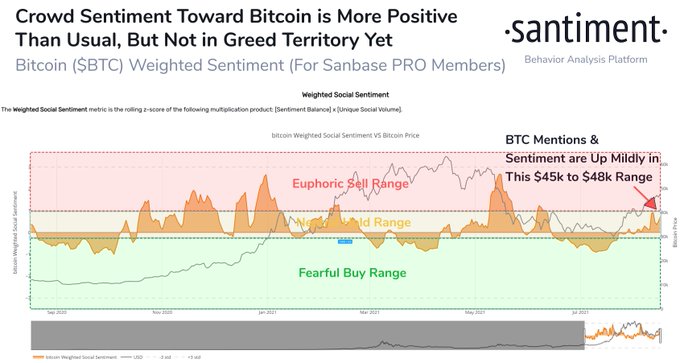

Crypto analytic firm Santiment explained:

“Bitcoin has settled into a $45K to $48K range that has encouraged traders to FOMO in anticipation of another run toward April’s ATH. Our data indicates optimism is up, but not euphoric in a way that leads to imminent BTC corrections.”

Bitcoin’s previous bull run touched an all-time high (ATH) price of $64.8K recorded in mid-April, prompted by significant institutional investment.

Nevertheless, a correction was imminent, which drove the price to lows of $28K as the crypto mining crackdown by Chinese authorities intensified from May.

Bitcoin stands at a region encountering heavy resistance

According to market analyst Michael van de Poppe, Bitcoin faced notable resistance between the $46K and $48K range. He explained:

“Bitcoin looks a bit over-exhausted in this region + heavy resistance.”

Crypto trader tweeting under the pseudonym CryptoHamster had previously noted:

“Bitcoin broke the 200D MA. The price is facing the resistance of the previously built sideways area with a large volume. One could anticipate the rejection from here initially, but if BTC keeps testing it, we might see the further evolution of the bullish scenario.”

Meanwhile, the three major central banks, namely the Federal Reserve (Fed), the Bank of Japan (BoJ), and the European Central Bank (ECB), seem to play an instrumental role in Bitcoin adoption.

Specifically, the value of BTC rises almost in tandem with the combined balance sheet of the three central banks. The combined balance sheet of Fed, BoJ, and ECB stands at almost $25 trillion.

Image source: Shutterstock

.jpg)